NEW ORLEANS - Exceptions to the Stark law and safe harbor provisions may provide the incentive to deliver healthcare information technology (HIT), in the form of electronic prescribing and electronic health record (EHR) systems, to small to mid-size physician groups in the U.S.

The cost of acquiring EHR and e-prescribing products has been cited as a road block to the widespread adoption of these technologies by the 70% of professionals who provide healthcare from groups of 15 or fewer physicians.

Hospitals and other large healthcare institutions are able to fund the acquisition of EHR and e-prescribing systems by leveraging the cost of the product across multiple revenue streams -- an advantage that smaller practices within its service area are unable to enjoy. However, to realize the maximum benefit from these HIT products, a hospital would prefer to have all the health service providers in its enterprise utilizing the systems.

The cost savings and clinical advantages available by adopting EHR systems is so profound that giving the technology to small and mid-size practices will provide a positive return on the gift to the donating institution. Although it seems an innocuous enough proposition, providing IT systems to clinicians from an institution that the clinician does business with is a violation of the Stark law and antikickback statutes.

Recognizing that its regulations were an impediment to HIT deployment, the U.S. Centers for Medicare and Medicaid Services (CMS) issued Stark exceptions and the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG) released antikickback safe harbor provisions for EHR and e-prescribing systems.

For practices and institutions seeking to enjoy the benefits of these forms of technologies, the rule releases provide much needed regulatory relief. However, the Stark exceptions and safe harbor provisions do not give carte blanche for full-scale equipment and system installs; in fact, both donor and recipient need to be aware of restrictions authored into these carve-outs.

"The government gives and the government takes away," noted Claudia Schlosberg, a partner in the Washington, DC-based law firm Blank Rome, who shared her observations on the CMS Stark exceptions and OIG safe harbor provisions in a presentation this week at the Healthcare Information and Management Systems Society (HIMSS) conference.

E-prescription

Schlosberg said that the e-prescribing Stark exception and antikickback safe harbor provision were created under the authority of the Medicare Modernization Act by Congress. It is specific only to e-prescription systems, and covers items and services necessary and used solely to transmit and receive electronic prescription information, including hardware, software, Internet connectivity, and training support.

Any individual or entity that provides services covered by a federal healthcare program, including health plans could be an e-prescription system donor; however, pharmaceutical, device, and durable medical equipment manufacturers or vendors cannot donate the technology.

What is protected under this carve-out, according to Schlosberg, are upgrades of equipment or software that significantly enhance functionality of the e-prescribing system. What is not protected, she said, are donations of items and services that duplicate what a physician already has or billing, scheduling, administrative, or other general office or bundled software. In addition, the system must be part of, or used to access, an e-prescription program that meets CMS e-prescribing standards.

EHR

The e-prescribing Stark exception and OIG safe harbor provision are good first steps toward easing the donation and adoption of HIT by small to mid-size physician practices; however, because it is limited to only a single system, it does not provide the latitude needed for full-scale information systems access.

Both CMS and the OIG issued a Stark exception and an antikickback safe harbor provision for EHR systems under the agency's authority under the Social Security Administration to address the issue of wide-scale HIT access, Schlosberg explained.

The covered technology includes interoperable software necessary and used predominately to create, maintain, transmit, or receive EHRs, Schlosberg said. It may include administrative functions, training, Internet connectivity, and help desk support, and it must include an e-prescribing capability.

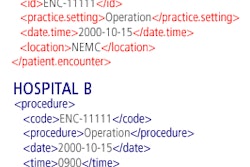

Interoperability is determined by CMS as to be able to communicate and exchange data accurately, effectively, securely, and consistently with different IT systems, software applications, and networks in various settings, as well as to exchange data such that the clinical or operational purpose and meaning are preserved and unaltered, Schlosberg said.

The recipients of the technology can be physicians, individuals, and entities engaged in healthcare delivery. The donor can be an entity that furnishes designated health services to a physician but cannot be an HIT vendor, a regional healthcare information organization (RHIO), a pharmaceutical manufacturer, or research-based biopharma industry, according to Schlosberg.

What is protected under this carve-out, according to Schlosberg, are software upgrades. What is not protected, she said, are donations of duplicative technology, hardware, or onsite staff support. Essentially, the protected EHR donation is the software and offsite training to install it, operate it, and maintain it.

In addition, an interesting value provision was included by the agencies in the carve-outs. Schlosberg said that EHR technology recipients must pay 15% of the donor's costs for donated technology and training before receiving the system. The donor is also prohibited from providing financing or loans for this 15% payment by the recipient.

"The cost allocation must be reasonable and verifiable, and it will be closely scrutinized," Schlosberg said. "In addition, upgrades and modifications to the donated EHR system will trigger new cost-sharing obligations."

Even if the Stark and antikickback issues for HIT donations are fully resolved, barriers remain for charitable hospitals making donations to physicians, Schlosberg noted. She said that the Internal Revenue Service has yet to release any guidance suggesting that the donation of any technology from a hospital to independent doctors would not jeopardize the tax exemption of the hospital. She also observed that these transactions could be seen as inconsistent with the purposes of a charity under some state law.

Schlosberg's advice for entities seeking to donate HIT systems and groups seeking to receive them is to create a written agreement vetted by both parties' healthcare attorneys. This agreement should, at a minimum, specify all items and services, the donor costs for those items and services, and the amount of the recipient's contributions, and be signed by donor and recipient representatives.

"Each arrangement must be evaluated individually," she said.

By Jonathan S. Batchelor

AuntMinnie.com staff writer

February 28, 2007

Related Reading

EHR deployment presents familiar obstacles, February 27, 2007

U.S. takes steps to ramp up HIT efforts, February 23, 2007

Frost forecasts EHR, clinical trial application convergence, January 23, 2007

Security considerations in transmitting medical information, January 19, 2007

CCHIT releases interoperability test scripts, data files, January 5, 2007

Copyright © 2007 AuntMinnie.com