PACS is a necessary tool for hospitals and imaging centers, both to complement digital modalities and to meet increasing productivity demands. PACS has proven to be a cost-effective solution for the management and distribution of radiology images for facilities performing thousands to tens of thousands of radiological studies per year.

However, PACS alone cannot deliver the desired results unless it is fully integrated with a DICOM-compatible RIS, as well as a full DICOM interface with imaging modalities.

When the RIS, PACS, and modalities operate and function as a single system, users can reduce film and chemical costs, reduce film-storage space requirements, and increase productivity due to better utilization of radiology assets. Most important, such a system will significantly improve service to patients and referring physicians.

A PACS enables nearly instant access to images and patient data within radiology, clinical areas in the hospital, and to remote users. In concert with a RIS and other clinical information systems, images can be integrated with the radiology report and with other patient information systems (such as laboratory, pharmacy, cardiology, and nursing reports).

According to PACS consulting firm Integration Resources of Lebanon, NJ, clinical studies show that radiologist and technologist productivity can be increased by 15%-20%, and higher, with a RIS/PACS, especially in CT and MR. In addition, CR shows productivity rate increases in the 10%-12% range.

Moreover, a single-tiered archive supporting a RIS/PACS network can provide access to all radiology images and patient data in real time. With a functioning DICOM modality worklist service, the system virtually eliminates redundant data entry or manual reconciliation of broken studies, another productivity improvement.

Up to 80% of hospitals already have a RIS in place, and it is usually integrated with a hospital information system (HIS). Therein lays the challenge: How to best achieve integration of the RIS database with the PACS database. The key to attaining successful outcomes with a PACS relies heavily on the archive architecture, network infrastructure, and full DICOM integration between the RIS, PACS, and imaging modalities.

Background

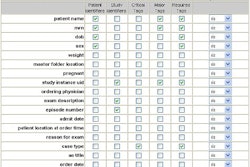

Digital imaging and the use of computers to process radiology images were first introduced in the 1970s. To manage digital images on an electronic archive, a database utilizes defined header fields to identify patient name, study type, accession number, referring physician, and so on. For the database to successfully query and retrieve studies the patient header data must be in the same location for all studies on the archive. This was an important hurdle vendors had to clear before PACS could be successfully implemented.

The difficulty is compounded by the fact that different modalities have different header organization and different field sizes. This can also be true for different modalities from the same manufacturer, and different models of that modality.

In order to develop a standard method for the transmission of medical images and their associated information, the American College of Radiology (ACR) and the National Electrical Manufacturers Association (NEMA) in 1983 formed a joint committee to create a universal standard, resulting in creation of the Digital Imaging and Communications in Medicine (DICOM) work group.

The DICOM work group’s charge was to achieve compatibility and uniformity of header data in medical images regardless of vendor or modality type. DICOM is a comprehensive standard that medical imaging vendors incorporate into product designs. Today, the DICOM Committee has a published standard that continues to evolve to cover other clinical imaging specialties such as pathology, dermatology, endoscopy, and ob/gyn.

RIS, and most HIS, have their own clinical information standard, known as Health Level Seven (HL7). HL7 is one of several American National Standards Institute (ANSI)-accredited Standards Developing Organizations (SDOs). Most SDOs produce standards or protocols for a particular healthcare arena. HL7’s area is clinical and administrative data. HL7 enables different HIS networks to exchange data between and among themselves.

Thus, DICOM is a transmission protocol that creates, stores, prints, and forwards image data to and from the imaging modalities and PACS. HL7 identifies patients, processes orders, and stores reports, but it cannot manage DICOM data.

A third player emerged with the collaboration of the Healthcare Information and Management Systems Society (HIMSS) and the Radiological Society of North America (RSNA) and industry vendors to oversee and improve integration between different information systems. This work group is known as IHE (Integrating the Healthcare Enterprise). IHE asserts that a comprehensive understanding of integration profiles as defined by the IHE initiative is also important.

IHE profiles are sets of DICOM and HL7 messages, and include specifications on how to map specific attributes between the two standards. They link the two languages in predefined ways for effective functioning and communication. IHE is essentially a concept statement -- a technical framework developed by the RSNA and HIMSS -- rather than a standard.

An RSNA statement says that IHE’s "goal is to stimulate integration of healthcare information resources. IHE is an initiative to improve the way computers share information. IHE promotes coordinated use of established communications standards such as DICOM and HL7 to address specific clinical needs in support of optimal patient care."

Brokered versus integrated RIS/PACS

The main difference between a brokered and brokerless interface connecting a RIS and a PACS is that the broker enables data exchange between HL7 and DICOM by means of a separate device.

A truly seamless integrated RIS and PACS is one in which the operating software can speak HL7 and DICOM without the help of any additional server or broker. Seamless integration means one fewer potential point of failure, resulting in better software functionality. Even with a seamless interface, however, there still may be DICOM problems when it comes to interfacing the modalities.

According to Gary Reed of Integration Resources, RIS products from different vendors and different versions from the same vendor all have different DICOM interface capabilities. Some RIS products are not upgradeable to support DICOM. The RIS must support the DICOM modality worklist, the DICOM performed procedure step, and the DICOM storage commit services.

When these services are functioning, there is a two-way interface between the RIS and PACS -- so that the RIS can track and manage the status of the specific study. It can tell the user whether the study has been read, the report signed, who opened the study, whether any changes were made, and whether all the images arrived at the archive.

"Many vendors will say they have a brokerless interface between the RIS and PACS," Reed said. "Very few actually do. Most who say they are brokerless have their own broker embedded within the system. You can call it brokerless but there is a broker in there."

Reed said that most vendors claim their RIS supports the HL7-to-DICOM interface. However, it may not support all the necessary DICOM classes and services. He said RIS/PACS customers should work with their RIS and PACS vendors and have them sign off on the actual functionality of the interface, rather than accepting a vendor’s DICOM conformance statement. The only way to really know if the RIS-to-PACS interface works is to install and test the different DICOM services to see how they function in the workplace environment.

Thus, there are benefits in integrating the RIS/PACS so it has a common database in which to exchange information, and presents a single desktop interface to the user. More often, a clinical facility will have a RIS and PACS from different vendors without seamless integration. This is what led to the use of broker interfaces.

A broker is a server and/or software that reconciles multiple databases. It was developed to take the HL7 from the RIS vendor and convert it into DICOM from the PACS vendor, or vice-versa. The most common broker on the market is made by Mitra, a Waterloo, ON, subsidiary of Greenville, SC-based Agfa HealthCare.

"The broker does the job well," said Rob Maliff, associate director of the Health Systems Division of ECRI, a nonprofit health services research agency in Plymouth Meeting, PA, that investigates devices and systems. "There is no perceptible speed difference to the user, but it is another box that IT has to maintain, so it’s a possible point of failure as well."

The interface between systems from different vendors can be "brokerless," as in the case of MeritCare Health System, a 583-bed hospital in two Fargo, ND, locations. Caryn Hewitt, MeritCare’s information systems manager, said there would be an interface engine between their IDX (Burlington, VT) RIS and the Philips Medical Systems’ (Andover, MA) PACS that is being installed.

"The IDX (interface) product has a worklist software functionality that pulls into each modality," Hewitt said. "Once the image is completed, it marries the demographic information that has come from the RIS with the exam that’s done on the modality, and then stores it in the PACS."

Not all brokered-systems users are totally sold on them. Shawn Hill, PACS coordinator at High Point Regional Health System in High Point, NC, said, "When you have another physical device that acts as a translator or interface, that could potentially be a point of failure. The (ideal) paradigm would be a fully integrated system -- and we might seek that in the future."

Maliff said a downside to brokered systems might exist when hospitals have an old RIS, and while these systems may work quite well, the PACS vendors may not want to make the effort to interface with them. With the current merger and acquisition climate, two hospitals in a system may have two different RIS networks. Matters are even more complicated when there are multiple RIS networks trying to integrate with a PACS, as there are multiple ways to access data -- whether by the accession number, the medical record number, or a master patient index.

"People ask whether they should just look at vendors that have RIS/PACS, and we caution them that you don’t have to purchase the RIS and the PACS from the same vendor," Maliff said. "While the integrated solution may be the best approach for the hospital, look at the RIS and what it’s going to improve, and look at the PACS and what it’s going to improve."

PACS consultants also caution that vendors' claims of a "single database" and "integrated" systems may be stretching the truth. Several vendors have merged products from acquired companies and called them "integrated," when what's really needed is interoperability between systems.

Michael Cannavo of PACS consulting firm Image Management Consultants in Winter Park, FL, said the downside to a single-vendor integrated system is that you’re locked into a RIS or a PACS that may not be the best for you. In other words, it may be better to pick a RIS from one vendor and a PACS from a different vendor to get the functionality you want. The upside of an interfaced (brokered) system from two different vendors is that you can always pull one out and put another one in.

Mercy Hospital in Des Moines, IA, recently installed a Kodak (Eastman Kodak Company, Rochester, NY) PACS with brokerless integration to the 700-bed hospital’s IDX RIS, which was also new (to avoid buying additional viewing station licenses from the RIS vendor, a Mitra broker was used to allow clinical display stations to access reports). According to Susan Johnson, the radiological administrator at Mercy, they had an HBOC (now owned by McKesson Information Solutions Medical Imaging Group, Richmond, BC) RIS in place, but it was too old to efficiently interface with the new PACS.

"The interface/integration standards today allow very tight coupling of products produced by different vendors," Cannavo said. "You should make your evaluations at least partly based on the track record of different vendors who’ve performed this type of integration at client sites in live environments."

A broker uses a common graphical user interface (GUI), common look, common feel, and common interface tools. When using a broker, the advantage is that you can interface with multiple applications or clinical systems. Most hospitals already have one or two interface engines, or brokers (for example, between the RIS and the HIS).

Cannavo said that maybe half of the installed RIS networks are beyond their return-on-investment period -- and the facility could stand to get a new one. He said there are things a new RIS can do, like entering charges for a procedure with or without contrast, or being able to change orders.

"It doesn’t take very many missed charges on a RIS for a CT with or without contrast and losing one of the two, to pay for a new RIS," Cannavo said.

Cost

Installation costs cannot really be nailed down, as each facility has different size and complexity requirements, and vendors don’t list RIS/PACS prices, saying they have to adapt to each unique facility’s requirements.

A typical integrated system is less expensive than buying the RIS and the PACS separately, because the integration cost is built in. Starting from scratch with a new integrated system is perhaps the least expensive approach, but this option may not be available to facilities with a RIS in place.

If you have a RIS, you can buy a hardware broker at a price point of $44,000-$70,000, according to consultants. Then the RIS and the PACS vendor will have to integrate their systems with the broker. A rule of thumb for RIS implementation is about $1,000 per bed, so a 400-bed hospital RIS can easily cost $400,000, according to Cannavo.

Many facilities are able to use a software broker, which installed is about half the cost of a hardware broker.

Costs for a PACS installation have no such rule of thumb; each facility varies in terms of number of stations, number of readers, and so on. For a hypothetical 400-bed hospital, a PACS can easily cost $4 million. At the same time, the PACS marketplace is extremely competitive.

Once a hospital or healthcare system selects a PACS vendor, it will be stuck with the company for many years, for better or worse. Buyers should beware of high-pressure pitches from salespeople, who may believe their systems can perform tasks they cannot.

In planning for the purchase of a RIS/PACS, or just a PACS, one should identify all the stakeholders. These people typically include the administrative director of radiology, radiologists, technologists, clerks, and the information systems administrator. It is also wise to sign on an administrative vice president and the CFO to champion the project.

Bells and whistles

The goal of a PACS is to provide real-time radiology service, and being filmless is one component of this service. A real-time radiology service consists of RIS, PACS, speech recognition, and a document imaging system to electronically manage paper.

Many radiology centers are also installing speech recognition capability, but the technology still has problems with speech patterns of various users, such as those with accented English. The upside of speech recognition is vastly improved speed of reports and decreased transcription costs. A downside is that the radiologist has to do his or her own editing, which may reduce productivity.

Increased throughput with a PACS or a RIS helps generate new revenue, and it will save money in areas such as film, film storage, and personnel. If you need both a RIS and a PACS, an integrated system may be the best solution. If you already have a RIS and it provides the functionality you need, it is probably more cost-effective to go with a broker interface. In other words, if it’s not broke, use a broker.

By Robert BruceAuntMinnie.com contributing writer

June 6, 2003

Related Reading

Web-based integration of PACS and RIS systems improves workflow, patient care, 5/12/03

IHE pursues user adoption, product development, IT expansion, May 12, 2003

Computerized order entry yields benefits, February 7, 2003

Voice recognition reduces report turnaround time in Vienna facility, December 4, 2002

Performance metrics can help maximize investment returns, July 29, 2002

Copyright © 2003 AuntMinnie.com