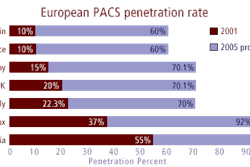

The Latin American market offers unique opportunities for PACS vendors looking to expand into international markets. In 2001, the value of the Latin American PACS market grew approximately 32% to reach about $3 million (U.S.), with an installed base of five sites (four in Mexico and one in Brazil).

Although revenues are predicted to grow explosively over the next six years, the Latin American market will remain small compared with North America and Asia. Nevertheless, within Latin America, Mexico, Chile, and Brazil hold the most promise due to their relatively high levels of healthcare sophistication, rising levels of healthcare spending, and in the case of Mexico and Brazil, a large number of tertiary-care medical centers.

There are some important caveats, however. As a whole, Latin America still has a long way to go with increasing adherence to the DICOM standard, especially in smaller cities and rural areas. Furthermore, in all but the largest urban hospitals, information technology infrastructure is seriously lacking. Macroeconomic instability, which could adversely affect medical IT and PACS spending, is also becoming a serious concern in Brazil, although it is much less of an issue in Mexico and Chile.

Mexico and Chile: Solid performers

Financial analysts consider Mexico and Chile as two enclaves of economic and social stability amidst the turmoil in Latin America. By macroeconomic measures, Mexico and Chile have the strongest economies in Latin America.

According to data from the World Bank and the Organization for Economic Cooperation and Development (OECD), Mexico's gross domestic product grew at an average annual rate of 5.5% from 1996 to 2000, while Chile’s grew at a 4.6% annual rate. Meanwhile, Brazil's GDP grew 1.9% annually and Argentina gained only 2.7% per year.

Mexico's nominal GDP reached $617 billion in 2001, overtaking Brazil for the first time to become Latin America's largest economy. Moreover, Mexico and Chile, already two of the most developed countries in the region, are expected to display strong growth during the next five years. In contrast, economic difficulties in Argentina, Colombia, and Venezuela are expected to force sharp cutbacks in government and private spending that could have negative consequences for the medical IT market.

Mexico: The prize

Although both Mexico and Chile are expected to constitute healthy medical IT markets, the real prize is Mexico, with over 100 major public and private medical centers distributed among the country’s five largest cities. Real economic growth, coupled with an expanded tax base, should provide Mexico's government with the means to significantly increase public investment in healthcare infrastructure, including PACS.

Officials at all levels of the Mexican government have publicly expressed their commitment to improving the country’s public health system. The Mexican Secretary of Health, for example, has emphasized the need to increase healthcare spending in Mexico.

Under President Vicente Fox, fiscal reforms and increased taxation are already being implemented to allow for additional public spending. In addition, government spending on healthcare increased by 55% in January 2002 compared with the same month in 2001.

Medical imaging professionals and administrators in Mexico are acutely aware of the country's lag in adopting the latest technologies, and they are eager to take advantage of potential increases in funding for the acquisition of high-tech image management systems.

An uncertain Brazilian market

Although the potential Brazilian market is larger than the Mexican sector, shadows are unfortunately beginning to fall across the Brazilian economic landscape. Brazil recently underwent a major currency devaluation, and economic uncertainty is heightened by the profound financial crisis taking place in Argentina, coupled with Brazil’s own enormous foreign debt.

As most large facilities in Brazil are at least partially funded by the federal government, a significant shortfall in tax revenues or a major financial crisis could indefinitely postpone major infrastructure projects such as PACS. Thus, the degree to which international vendors will be able to generate revenues in the Brazilian market depends on a number of variables.

Nevertheless, if Brazil is able to maintain a stable financial situation with a modicum of economic growth, revenue growth in the Brazilian PACS market should follow the Mexican pattern, with a number of elite, early-adopter facilities providing a growing source of market revenues.

Major public medical centers and private hospitals in major Latin American cities are beginning to implement PACS. In 2001, Siemens Medical Solutions of Erlangen, Germany completed two important PACS installations in Latin America, at Mexico City’s La Raza Medical Center and at São Paulo’s Hospital do Coração in Brazil.

Once the first elite facilities offer the latest in image management, there will be intense pressure for the remaining hospitals (both public and private) to follow suit. Otherwise, they risk losing patients and revenues to facilities that are regarded as more technologically advanced by demanding, high-income healthcare consumers.

Barriers to hurdle

Apart from macroeconomic concerns, there are other structural factors that must be overcome in order for the Latin American PACS market to reach its full potential. Only 5% of the imaging installed base in Latin America operates on the DICOM standard.

Clearly, this is an immense barrier to the proliferation of PACS. Without a standard set of protocols for the formatting and transmission of digital medical images among the various imaging modalities, it's impossible to implement a PACS network. Although elite facilities in Brazil, Chile, and Mexico are expected to implement DICOM, the overwhelming majority of facilities in the region will not operate consistently on the standard for several years.

Moreover, most administrative and information management functions in Latin America are still conducted with paper files. For example, only 30% of major hospitals (300 beds or more) in Brazil and about 20% in Mexico have any kind of hospital information system.

Clearly, the remaining 70% to 80% of facilities are in no position to contemplate a PACS purchase without first implementing a baseline level of IT infrastructure. Accordingly, the low penetration of healthcare IT in the region is expected to act as a barrier to the broader proliferation of PACS beyond the elite facilities during the next few years.

A promising outlook for some

Frost & Sullivan predicts a promising outlook for PACS in Mexico and Chile, with a qualified positive forecast for Brazil as well. Only the largest and most sophisticated hospitals in these countries, however, will have the financial and technological resources required for a full-scale PACS implementation.

In general terms, the largest, most prestigious facilities with the most influential leadership, such as La Raza Medical Center in Mexico City and São Paulo’s Hospital do Coração, will be the first to implement PACS. A respectable number of prospective PACS buyers, particularly in Mexico, are expected to follow suit in coming years.

By Antonio GarcíaAuntMinnie.com contributing writer

August 13, 2002

Antonio García is a medical imaging industry analyst at Frost & Sullivan, a San Antonio, TX-based market analysis, consulting, and training firm. The data and analysis in this article are included in a recently published Frost & Sullivan report on the PACS market: "The North American, Asian and Latin American PACS Market (A184-50)." For more information, please contact Charlie Turnbow at [email protected] or visit healthcare.frost.com.

Related Reading

3-D imaging in Europe: The jewel in the crown, May 30, 2002

PACS: The best thing to happen to RIS?, February 18, 2002

Copyright © 2002 AuntMinnie.com