Driven in large part by a desire to simplify their enterprise storage strategy, hospitals are increasingly adopting or are planning to implement vendor-neutral archives (VNAs), according to a new report from healthcare technology research and advisory firm CapSite.

The Williston, VT-based company surveyed 250 U.S. hospitals and found that 19% had invested in a VNA between 2008 and 2010. And 25% of respondents are planning to invest in a VNA.

"We found a great deal of activity in this space, and it surpassed our expectations in terms of recent purchases," said Bryan Fiekers, director of business development. "In addition, there is a strong and growing demand for vendor-neutral archives going forward."

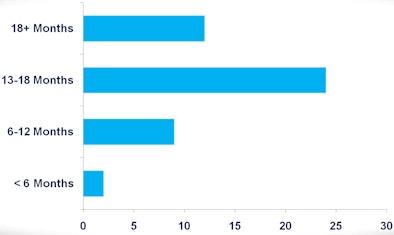

|

| Time frame for planned VNA purchase according to number of hospitals. All images courtesy of CapSite. |

The definition of what constitutes a VNA can make it confusing to evaluate this market. For the purposes of the study, CapSite defined a VNA as software that acts as a middleware application between one or many clinical workflow applications and various storage platforms and IT strategies. The VNA will support one or many clinical viewing applications, a standards-based environment, storage virtualization strategies, robust business continuity deployments, and virtual environments, CapSite said.

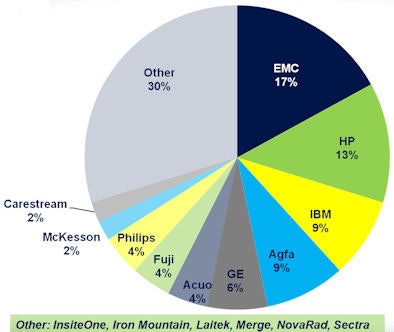

|

| Primary VNA vendor. |

The need to simplify storage and archiving is one of the key forces driving the VNA market, Fiekers said.

"There are a number of unique systems within a hospital environment, and there's a greater demand for access across the hospital, [including] the various departments that are requiring access to these images," Fiekers said. "And in addition to that, there are hospital departments that are expecting to grow as well."

When asked to select their top two reasons for considering a VNA purchase, by far the most popular was rationalizing an enterprise storage strategy, followed by avoiding future migrations, a simplified electronic medical record (EMR) viewer access strategy, and the ability to share data across multiple PACS.

In other findings, when asked how participants are viewing their next PACS, 52% consider it a multipurpose archive for PACS and other imaging sources requiring future migration. Thirty-nine percent view it as an application leveraging enterprise VNA storage, and 9% consider it a siloed PACS requiring future migration.

"People are starting to think about archiving more strategically as part of a more proactive plan to address the expected image data growth over the next several years," said Gino Johnson, CapSite vice president. "You can see that they're thinking about archiving solutions a little more proactively as opposed to passively."

For more information on the report, click here.

By Erik L. Ridley

AuntMinnie.com staff writer

November 11, 2010

Related Reading

Report: Cardiac IT market gaining momentum, September 24, 2010

Report: Remote radiology market is active, fragmented, September 14, 2010

U.S. PACS market rides on replacement sales, June 25, 2010

Report: Storage, SR to pace imaging IT, April 22, 2010

Copyright © 2010 AuntMinnie.com