Just a few short years ago, being a dedicated PET vendor was a lonely calling. The U.S. PET market seemed permanently stillborn, and most nuclear medicine vendors were trying their best to either avoid the PET label or get out of the market altogether.

How times have changed. U.S. PET sales are skyrocketing, thanks to improved reimbursement and heightened interest in molecular imaging. Nuclear medicine vendors are finding that they must have a PET product in their catalog in order to compete. It's a whole new ballgame.

One company that's benefiting from the shift is CTI, a Knoxville, TN, firm that has staked its entire business model on PET. CTI is best known as the firm that supplies PET cameras to the nuclear medicine group of Siemens Medical Solutions of Hoffman Estates, IL, through CTI PET Systems, a joint venture between the firms. Once an exclusive relationship, CTI is now branching out, taking on a direct sales role and establishing relationships with other vendors to sell CPS scanners.

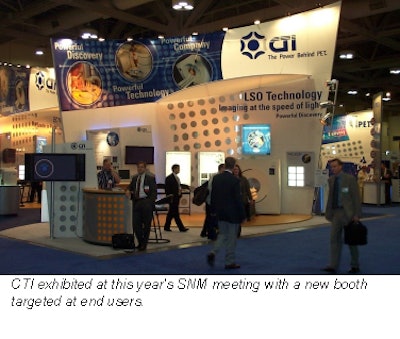

CTI highlighted its new focus at the 2001 Society of Nuclear Medicine meeting in Toronto, where the company exhibited in a booth designed to attract end-users. It also discussed its ongoing work on new PET technology designed to speed the modality's transition from research tool to routine clinical use.

|

Focusing on PET

CTI's main activities fall into five areas:

- PET scanner manufacturing, through CPS

- Cyclotron manufacturing

- (18) Fluorodeoxyglucose production and distribution, through CTI's P.E.T.Net Pharmaceuticals subsidiary

- Equipment service, which provides radioactive sources and equipment maintenance for PET scanners and cyclotrons

- Detector-material manufacturing, including bismuth germanate (BGO) and lutetium oxyorthosilicate (LSO)

The company is privately held, with vendors such as Siemens, Marconi Medical Systems of Cleveland, and Japan's Seiko holding small minority interests. CTI's annual revenues are about $50 million, and it has more than 500 employees, according to Terry Douglass, CTI's president and CEO.

CTI decided to explore new marketing channels when its exclusive relationship with Siemens expired last September. Although the relationship had been productive, CTI felt it could find new markets by signing on new partners while retaining the Siemens relationship, Douglass said. One of CTI's first coups was a relationship with Marconi, which received rights to sell CPS systems.

CTI will differentiate its own offerings from those of its partners by offering PET systems bundled with radiopharmaceuticals in a package that CTI is calling PowerSolutions. "CTI's strategy will be to combine the scanner and the radiopharmaceutical with the PowerSolutions concept and present that to potential providers as a total package," Douglass said.

P.E.T.Net is the key to the bundled strategy. CTI originally started P.E.T.Net as a joint venture with radiopharmacy firm Syncor International of Woodland Hills, CA. A group of private investors took over the Syncor position in 1997, and CTI bought out those investors in September 2000, Douglass said. There are currently 24 cyclotrons in P.E.T.Net's network, with a new site being added each month. The company's objective is to have 60 sites by 2005.

CTI is also making changes in P.E.T.Net's business strategy, by adding an R&D capability to the division. P.E.T.Net has formed the L.A. Tech Center in Culver City, CA, as a joint venture between the company and the UCLA School of Medicine in Los Angeles. The center's goal is to evaluate developmental pharmaceuticals that could prove to be promising agents for the diagnosis and treatment of cancer and other diseases.

P.E.T.Net is collaborating on another research facility, the Molecular Imaging Research Center, with the University of Louisville in Kentucky. That site is scheduled to open in early 2002, and will include a CT/PET scanner.

While it launches these initiatives, CTI continues to cultivate its PET scanner business. The company is expanding from its core BGO technology into novel new systems, such as a hybrid CT/PET camera built in cooperation with Siemens, which markets the system as Biograph. While the system currently comes packaged with a single-slice Siemens scanner, CTI plans to offer a multislice configuration, according to Ron Nutt, the firm's senior vice president and technology director.

Cameras with new detector materials such as LSO are another area where the company's R&D efforts are bearing fruit. The lead product here is ECAT Accel. CTI believes that LSO has major advantages over bismuth germanate (BGO) crystals: LSO puts out more light than BGO, and its light dissipates more rapidly, enabling the detectors to process photons more quickly.

As a result, scanning times are shorter -- the current scanning time for a typical ECAT Accel study is 35 minutes, compared with 55 minutes for a BGO exam. Exam times as low as 25 minutes are also possible, according to Dr. Peter Valk, medical director at Northern California PET Center in Sacramento, where the first ECAT Accel is installed. CTI will also offer LSO crystals in the hybrid CT/PET system.

CTI's rollout of the new technologies couldn't be better timed. Douglass estimates that the U.S. market for PET cameras is growing at a rate of 50% per year, with sales of $200 million expected for this year. Demand for PET radiopharmaceuticals is increasing 100% a year, generating $60 million in revenues. That growth is being passed on to CTI, according to Douglass.

"We are growing a rate faster than 50% a year," he said. "We are a $200 million company now. We expect to be a $1 billion company five years from now."

By Brian CaseyAuntMinnie.com staff writer

August 6, 2001

Related Reading

Marconi rolls out dedicated PET offerings at SNM show, June 27, 2001

CTI PET adds Marconi as distributor, rolls out ECAT Accel, May 11, 2001

Copyright © 2001 AuntMinnie.com