Radiology administrators are not convinced that their practices will have adequate reimbursement from Medicare for diagnostic and interventional imaging, yet they do remain optimistic that imaging will grow as a profit center in the coming months.

These results come from The MarkeTech Group's Medical Imaging Confidence Index (MICI) third quarter 2025 report, which found a "neutral" overall confidence score regarding five areas of practice.

"All hospital bed sizes have low confidence they will receive adequate reimbursement, but high or very high confidence in both monthly volume growth and growth as a profit center," the report stated.

Administrators also have very high confidence that diagnostic and interventional radiology volumes will grow monthly, with a ranking equal to Q2 2025 results. But as in the company's last survey, their confidence is neutral that internal operating expenses and staff costs will remain constant and that they will have access to capital for imaging equipment and IT needs.

The MarkeTech Group produces the MICI report using survey response information contributed by radiology administrators and business managers who are members of its imagePRO panel. The survey is made up of responses to questions about trends radiology administrators face in the coming year and was conducted between June 16 and July 3.

This third-quarter report included feedback from 108 imaging directors and managers across the following U.S. geographic areas: 18% in the West North Central region, 10% in the East North Central region, 11% in the Mid-Atlantic region, 14% in the South Atlantic region, 14% in the East South Central region, 18% in the West South Central region, 12% in the Pacific region, and 4% in the Mountain region.

As for hospital/facility size, 53% of survey respondents reported 100 beds or less, 32% reported 100 to 299 beds, and 19% reported 300 beds or more.

For the survey, participants rank their confidence on five topics, and The MarkeTech Group calculates a single composite score. Scores range from 0 to 200 and can be interpreted according to the framework below:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

For the third quarter of 2025, the report found the following:

| MICI Q3 2025 confidence scores by topic | ||||

|---|---|---|---|---|

| Topic | Mean score Q2 2025 | Interpretation | Mean score Q3 2025 | Interpretation |

| Will maintain/grow as a profit center | 132 | Very high confidence | 139 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 132 | Very high confidence | 132 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 106 | Neutral | 99 | Neutral |

| Internal operating and staff costs will remain constant | 99 | Neutral | 99 | Neutral |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 85 | Low confidence | 76 | Low confidence |

| Composite score across all areas | 110 | Neutral | 108 | Neutral |

By U.S. region, results were mixed:

- The Mid-Atlantic, East North Central, East South Central, Mountain, South Atlantic, and Pacific regions reported overall high or very high confidence in volume and/or profit growth.

- The Mountain, West North Central, West South Central, and Pacific regions reported low or very low confidence in reimbursement and/or availability of capital for equipment and IT.

The overall result is that administrators' confidence is neutral or the same as Q2 2025, but significantly lower than the previous period regarding whether their departments will receive adequate reimbursement.

"Several [respondents expressed] concern that the political situation will affect their practice, [stating that] potential tariffs and cuts to Medicaid are significant sources of uncertainty," the report noted.

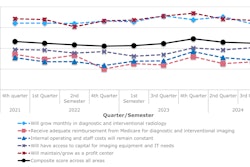

Quarter-to-Quarter analysis of Q4-2022 through Q3-2025Graph courtesy of The MarkeTech Group.

Quarter-to-Quarter analysis of Q4-2022 through Q3-2025Graph courtesy of The MarkeTech Group.

The survey also includes a free-response section where administrators may comment on the five topics. A sample of the free responses is below.

Regarding study volume increases and planned growth, participants said the following:

- "At the current time, I am anticipating growing the cardiac CTA business from six to eight cardiac studies a day to 12 to 15. In interventional radiology, we … have begun training staff for procedures to include Y-90, TIPS [transjugular intrahepatic portosystemic shunt], embolizations and cryoablations."

- "Several new specialized providers (GI, podiatry, neuro, ortho) are coming to our facility!"

- "Onsite radiologist coverage may decrease over the next several months."

Regarding healthcare policy and Medicare reimbursement, administrators expressed concern, stating the following:

- "Government payors are not reliable currently."

- "My only concern would be if contrast gets tariffed."

- "Not sure how tariffs will affect expenses this time. Our Secretary of Health is clinically incompetent, so there are concerns about moving healthcare forward under his tenure."

- "Reimbursement for rural health is not adequate. Payor mix is too high for Medicare and Medicaid."

- "Political scene is crazy right now. But even if the bills pass, it takes a bit before [they] take effect."

Finally, regarding internal operations and staffing, survey participants noted:

- "Increasing wage inflation due to lack of full-time staff and increased reliance on contract or agency staffing."

- "June and July are vacation season for providers [and we] usually see volumes drop slightly."

The Medical Imaging Confidence Index (MICI) is produced by market research firm The MarkeTech Group using data from its imagePRO panel of radiology administrators and business managers.