This article originally appeared in the American Journal of Roentgenology, written by Dr. Howard Forman, associate editor of health policy for the American Roentgen Ray Society (ARRS).

In this column, I will give an overview of the condition of the program and assess its viability. The reader is encouraged to visit the U.S. Centers for Medicare and Medicaid Services (CMS) Medicare Web site for further information. Much of the information in this brief is culled from the current Medicare Trustee's report, issued on March 23 this year.

In 2004 Medicare covered 41.7 million people, of which 6.3 million were disabled nonelderly. The total benefits paid were $303 billion. At present, the Hospital Insurance (HI) part of the program (Part A) is not appropriately funded, with more money flowing out in payments for services than flowing in from the 2.9% tax levied on employees' wages (split equally between an employee and employer tax).

By 2020 the trust fund will be extinguished, and the program would presumably be a pay-as-you-go system. Given that the revenues are predicted to be just a fraction of the costs, this would imply hefty tax increases or similar benefit declines.

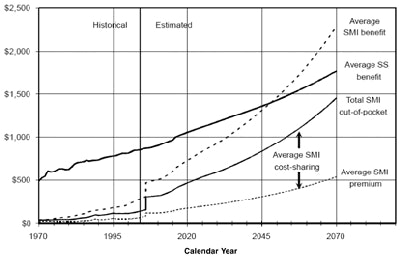

Figure 1 shows the divergence between costs and income for the HI program. Note the gray triangle, which indicates the full current value of the trust fund.

| Figure 1, long-range HI income and cost as a percentage of taxable payroll |

|

| Source: CMS, 2005. |

The reality of this chart is that the divergence is substantial, and because the HI program is legislated to be self-financing, there is little time to manage some dramatic change. Note that in the relatively distant future, the payroll tax would literally have to quadruple to maintain balance in the program's budget. To those who think that the cost projections are out of line, I will only add that these are the "intermediate" assumptions; the high-cost assumptions make the divergence much worse.

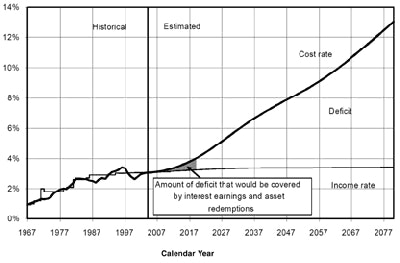

Figure 2 shows the three scenarios side by side. Even the low-cost scenario would require more than a doubling in payroll tax.

| Figure 2, three cost-based scenarios for HI |

|

| Note that the relative payroll tax under the low-cost scenario would still need to double to achieve budget balance in this program. Source: CMS, 2005. |

Although it is the HI trust fund that gets much of the press and attention, it is the Supplemental Medical Insurance (SMI) program (Part B) that is likely to become a major immediate issue for seniors and physicians. This program is funded with a premium from the beneficiary (25% of the program's cost) with the remainder being paid out of the general tax revenues of the U.S. government.

It is set in statute, and, thus, cannot go bankrupt or default on its obligations. On the other hand, both sets of funds are automatically reset each year by the increase in Medicare Part B inflation, which has been exceedingly high. Beneficiaries are seeing double-digit increases in their premiums, coming out of their barely rising Social Security checks; the federal government is seeing fast-growing costs, contributing mightily to the current budget deficit.

Worse, the current immediate rise in costs for this program assumes that physician fees will fall in the 2006 budget. Since we all hope this does not happen, the implications for the program and the beneficiaries are even more dire. Furthermore, it would seem that we (physicians) will become a greater target when it is suggested that our increased pay is tied directly to the increasing cost of premiums.

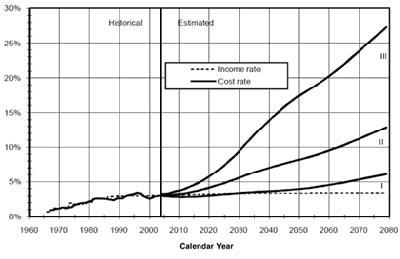

Figure 3 represents the current status of Part B (and the soon to be Part D) Medicare prescription drug benefit. Note the steady rise in beneficiary premiums and the even more dramatic component being paid by federal revenues. As an ever-increasing percentage of the gross domestic product, this is unsustainable from a budgetary standpoint.

| Figure 3, SMI expenditures and premiums as a percentage of gross domestic product |

|

| Part D refers to the new Medicare prescription drug benefit. Source: CMS, 2005. |

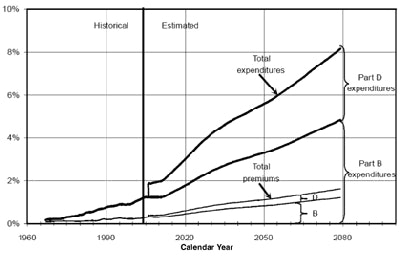

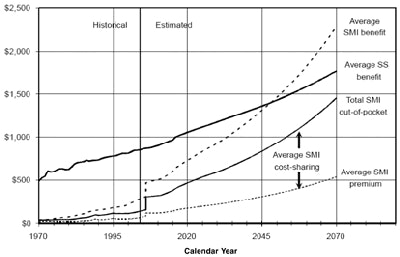

Finally, figure 4 gives some long-range perspective to the costs of the Medicare and the Social Security programs. Note that by the midportion of the current century, the federal government will be spending more money on a per-capita basis on Medicare than it does on the currently constructed Social Security benefit.

As an analogy, it would be as if you were spending half of your income on health benefits and the remainder as taxable income. From the beneficiary perspective, it is not much better. Within a few years, the average beneficiary will be spending more than $500 per month in out-of-pocket expense (in today's dollars) on healthcare costs. Given the generally fixed resources of our nation's elderly and disabled, this is a troubling concern.

| Figure 4, comparison of average monthly SMI benefits, premiums, and cost-sharing to the average monthly Social Security benefit |

|

| Amounts in constant 2004 dollars. Source: CMS, 2005. |

These charts illustrate the sobering reality that Medicare is in a critical state and that, without change, the problems Medicare faces will only be amplified. In the next brief, I will reflect on the changes Medicare Payment Advisory Commission (MedPAC) has suggested for the Medicare program in 2005. Many of these changes target our specialty.

By Dr. Howard P. Forman

AuntMinnie.com contributing writer

June 15, 2005

Dr. Forman is an associate editor of health policy for the American Roentgen Ray Society (ARRS). This article originally appeared in the American Journal of Roentgenology (June 2005, Vol. 184:6). Reprinted by permission of the ARRS.

Related Reading

Health benefits at work: what to expect in the future, May 24, 2005

National health expenditures and another year of 'unsustainable growth,' May 4, 2005

ACC, ACR debate stats on imaging growth, April 18, 2005

ACR criteria cut imaging costs in Israel, January 11, 2005

ACR to pitch Congress on 'designated physician imagers' for Medicare, January 6, 2005

Copyright © 2005 American Roentgen Ray Society