GE Healthcare has completed its acquisition of U.K. pharmaceutical giant Amersham, creating a $14 billion company that will combine GE's medical imaging and informatics experience with Amersham's work in diagnostic pharmaceuticals and drug discovery.

The combined firm aims to drive development in molecular imaging and "personalized healthcare," enabling providers to predict, detect, and treat disease earlier, possibly before patients exhibit physical symptoms, according to GE Healthcare Technologies president and CEO Joseph Hogan. As molecular understanding of disease advances, treatment could be tailored to patients more specifically and less invasively, he said.

"When you look at advanced disease states, one out of every three people in the world will have cancer in their lifetime, and (with) heart disease, almost 50% of people die with their first heart attack, and (in) brain disorders or neurological disorders, 20% of people experience that between the ages of 75 and 84," Hogan said. "So cancer, heart disease, and neurology will be the three key areas that we'll focus this technology around."

Upon closure of the deal, GE formally created a new company, GE Healthcare, which will comprise its $11 billion GE Healthcare Technologies unit (the former GE Medical Systems) and the $3 billion GE Healthcare Bio-Sciences business (the former Amersham operations).

GE Healthcare will be based in Chalfont St. Gile, U.K., and will be under the leadership of president and CEO Sir William Castell, formerly Amersham's chief executive. Joseph Hogan will remain president and CEO of GE Healthcare Technologies, which will retain its headquarters in Waukesha, WI.

Previous Amersham COO Peter Loescher has been tapped as president and CEO of GE Healthcare Bio-Sciences, which will base its operations in Little Chalfont, U.K. Both Hogan and Loescher will report to Castell.

Collaboration between the GE Healthcare units will take place on several levels, with the goal of achieving technology breakthroughs. GE's Global Research Center in Schenectady, NY, will host the joint research projects, Hogan said. The two units will also work together during both the early and later stages of product development cycles.

"(For example), GE is going to introduce a 64-slice CT scanner in the fourth quarter, and that's very valuable information to exchange with (GE Healthcare Bio-Sciences) as far as contrast agents that will be used in cardiac or different procedures," Hogan told AuntMinnie.com. "So when we go out and sell, we can inform the provider about what the nuances and opportunities are in both of these things."

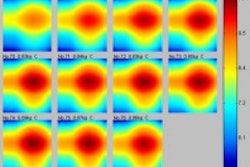

The collaboration will also bear fruit in the development of the next generation of volumetric CT technology, for example, Hogan said.

Functional imaging is an application that makes particular sense for collaboration, said Dan Peters, acting COO for GE Healthcare Bio-Sciences.

"There's really an opportunity to have our people put our minds together from the medicinal chemistry side and also the technology side to really understand how this new technology is best going to be used," Peters said. "This is a technology that does need the combination of the equipment and pharmaceutical side."

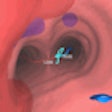

GE and Amersham had been working together prior to the acquisition, teaming up on the development of F-18 fluorothymidine (FLT). GE had inked a clinical trials agreement with the National Cancer Institute in November 2003 for multisite clinical trials of FLT, a PET radiopharmaceutical used to image DNA synthesis.

The GE units are also working to develop the ability to scan amyloid plaque, a potential indicator of Alzheimer's disease, Peters said. The technology, still in the early stages of development, is being licensed from the University of Pittsburgh.

GE is in a relatively unique position, having both imaging modality and contrast agent product lines in-house. However, GE doesn't plan on bundling scanner sales with contrast contracts, Hogan said.

"We want to sell the way customers want to buy," he said. "We'll approach customers and from a clinical standpoint, explain the values of both our imaging equipment and our contrast capability, and customers can decide from there."

GE Healthcare expects to generate $16 billion in revenues in 2005. Annual R&D spending will reach approximately $1 billion, according to the firm.

By Erik L. Ridley

AuntMinnie.com staff writer

April 8, 2004

Amersham OKs GE acquisition, March 19, 2004

Amersham sales grow in 2003, February 19, 2004

GE/Amersham deal clears hurdle, January 22, 2004

Amersham shows growth in Q3, October 30, 2003

GE makes $9.8 billion bid for Amersham, October 10, 2003

Copyright © 2004 AuntMinnie.com