The therapeutic radiopharmaceuticals will also offer an attractive investment opportunity for many of the companies and venture groups supporting these programs. These agents will be used in conjunction with traditional therapies, enhancing their effectiveness, with better specificity and reduced side effects.

The market for therapeutic radiopharmaceuticals was still on the threshold in 2005, with total sales of $57 million. Rapid growth is anticipated over the next five to six years. By 2012, therapeutic product sales should reach $1.9 billion, with rapid growth thereafter.

The increasing interest in new therapeutic radiopharmaceuticals is prompting investigators to utilize isotopes with more focused capabilities for treating various tumors, reducing the negative effects on neighboring healthy cells.

Whereas current therapeutic radiopharmaceuticals have employed only two isotopes, yttium-90 and iodine-131, future products will employ both beta and alpha emitters in which the shorter particle range and high-energy deposition can be used to advantage to destroy DNA directly. A number of products are in development employing lutetium-177, promethium-149, bismuth-212, bismuth-213, astatine-211, radium-223, and polonium-210.

Historical perspective

The market for therapeutic radiopharmaceuticals crossed a major threshold in 2002 with the approval of Zevalin (Biogen Idec, Zug, Switzerland) for treating non-Hodgkin's lymphoma. This was followed in 2003 with the approval of Bexxar (Glaxo SmithKline, Research Triangle Park, NC) for similar indications. Zevalin is based on Rituxan (Biogen Idec), an antibody product for the treatment of non-Hodgkin's lymphoma. With Zevalin, yttium-90 is linked to the antibody, adding the therapeutic effect of the isotope to target the lymphoma cells.

Prior to Rituxan's introduction, there were no targeted therapies for lymphoma and the outcomes were poor for many patients. Therefore, Rituxan added significantly to the treatment options and has been extremely effective in treating patients resistant to more conventional therapies. In fact, Rituxan has become the most widely distributed oncology drug in the world, reaching blockbuster status with sales of $1.6 billion per year. Nine other antibody products have been approved since 2002 with growing market acceptance. These technologies create a good platform for conveying therapeutic isotopes to enhance performance in cancers resistant to traditional therapies.

The learning curve

One would imagine that the success of Rituxan would create an excellent platform for Zevalin because of the proven success of the underlying antibody. However, this has not been the case. Medical oncologists have been resistant to refer patients out of their practices to radiation oncologists who are qualified to administer radioactive drugs. Since oncologists derive a significant portion of their income from administering chemotherapeutic drugs, they tend to wait until all options are exhausted before referring patients to other physicians.

The lymphoma patients referred to radiation oncologists for treatment with Zevalin have already failed the basic antibody treatment and are less likely to respond than if they were referred earlier before their condition deteriorated. So, in a way, the success of Rituxan has worked against the wider use of Zevalin even though the potential exists to improve the outcomes for many patients. Notwithstanding these limitations, sales of Zevalin and Bexxar have been increasing gradually as both companies work to educate oncologists of the potential benefits.

On the positive side, therapeutically targeted radiation has been validated with Zevalin and Bexxar. This has led to a surge in research activity to expand applications for therapeutic radiopharmaceuticals. Current approaches employ more sophisticated targeting methodologies and more appropriate therapeutic isotopes for the tumors being treated. The investment community also has more confidence with respect to the prospects for U.S. Food and Drug Administration (FDA) approval of these drugs.

| Table 1: Therapeutic pipeline products | ||||

|

||||

| Indication | Company | Product | Est. entry date | |

|

||||

| Lymphoma | Immunomedics | Y-90 Epratuzomab | 2008 | |

| Lung cancer | Peregrine Pharmaceuticals | I-131 Cotara TNT Therapy | 2008 | |

| Erasmus Medical Center - Netherlands | Y-90 Lanreotide | 2008 | ||

| Bracco Diagnostics | Lu-177 BB2 Bombesin GRP | 2009 | ||

| Erasmus Medical Center | Lu-177 Octreotate | |||

| Prostate cancer | Millennium Pharmaceuticals | Lu-177 PSMA Ab J-591 | 2008 | |

| Bracco Diagnostics | Lu-177 Bombesin GRP Agonist | 2008 | ||

| Cytogen | Lu-177 PSMA Antibody | 2009 | ||

| Breast cancer | Bracco Diagnostics | Lu-177 Bombesin GRP | 2008 | |

| Immunomedics | Y-90 Anti-CEA Antibody | 2009 | ||

| Colon cancer | Immunomedics | Y-90 Pretargeted Bispecific Ab | 2008 | |

| Peregrine Pharmaceuticals | I-131 Cotara TNT Therapy | 2008 | ||

| Pancreatic cancer | Immunomedics | Y-90 PAM4 Antibody | 2008 | |

| Myeloma | Dow Chemical | Ho-166 STR Therapy | 2008 | |

| Endocrine cancer | Novartis | Y-90 Octreother | 2008 | |

| Erasmus Medical Center - Netherlands | Lu-177 Octreotate | 2008 | ||

| Liver cancer | Immunomedics | Y-90 AFP Antibody | 2009 | |

| Skeletal cancer/sarcoma | Dow Chemical | Ho-166 STR Therapy | 2008 | |

| Algeta, Norway | Ra-223 Alpha Therapy | 2008 | ||

| Brain cancer | Peregrine Pharmaceuticals | I-131 Cotara TNT Therapy | 2008 | |

| Duke University | At-211 Alpha therapy | 2010 | ||

| Melanoma | University of Missouri | Bi-212 Melanocortin Alpha | 2009 | |

| Ovarian cancer | Algeta, Norway | Liposomal Pb-212 Alpha | 2009 | |

| Multiple solid tumors | Peregrine Pharmaceuticals | I-131 Cotara TNT Therapy | 2009 | |

| University of Maryland Consortium | Po-210 Alpha Anti-Vascular | 2010 | ||

|

||||

Major progress in international cooperation

As cancer research has accelerated worldwide, communication has improved, allowing researchers internationally to share information more openly with colleagues in the U.S. One example is a product developed by Tustin, CA-based Peregrine Pharmaceuticals (I-131 Cotara TNT) has recently been approved for brain cancer therapy in China. The data derived will help Peregrine and others to better understand the potentials of this technology, hopefully accelerating FDA approval in the U.S.

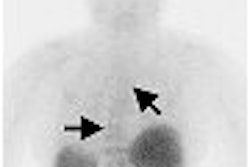

In another case, Dr. Eric Krenning and Dr. Marion de Jong at Erasmus Medical Center in Rotterdam, Netherlands, have been doing some landmark research with peptide receptor radiation therapy with 90Y-DOTA0,Tyr3-Octreotide and 177Lu-DOTA0,Tyr3-Octreotate. These are somatostatin analogs that are directed toward neuroendocrine tumors. They have treated more than 100 patients with excellent results by utilizing a unique patient-specific dosimetry, optimizing the dosage for each patient to minimize renal toxicity.

Russian American Cancer Alliance

The Russian American Cancer Alliance was approved by the U.S. Congress for the purpose of supporting cooperative cancer research programs for its members. In the U.S., charter members are the Fox Chase Cancer Center in Philadelphia and the University of Maryland Greenbaum Cancer Center in Baltimore. One of the primary Russian Federation participants is the Kurchatov Institute in Moscow.

The institute is a federal facility that supplies isotopes to the Russian American Cancer Alliance through its network and affiliations with other nuclear facilities in Russia. The alliance also supplies isotopes to nonmember facilities, but does not sell the isotopes. All of the relationships are partnerships whereby grants are shared in research agreements. This is advantageous since a number of isotopes available in Russia are not offered in the U.S.

New technology opportunities

Two approaches are being pursued with therapeutic radiopharmaceuticals:

- Antibody-based drugs

- Targeted peptides linked to therapeutic isotopes

There is more experience with antibody-based drugs, and they appear to offer less of a challenge in terms of renal toxicity. The peptides are smaller molecules that clear more rapidly, but tend to be more toxic to the kidneys. However, antibody products have their own problems in terms of large molecule size that circulate for long periods of time.

One approach that has stimulated considerable interest is bispecific antibodies that allow pretargeting, in which the drug is administered in two stages. The target antibody is first administered in nonradioactive form. This seeks out the tumor receptors and locks on to them. The unassociated antibody is then allowed to clear the system. A second injection is made later with the radioactive component. This has a linker that seeks out the free arm of the bispecific antibody, minimizing the radioactive material in circulation. Immunomedics of Morris Plains, NJ, has been pursuing this approach for some time and has reported promising results.

Another growing area of interest is the use of agonists, which seek out tumors and stimulate cellular growth. However, the agonists are linked to a therapeutic isotope that destroys the cell internally. Bombesin is the agonist commonly linked to Y‑90 or Lu-177 that targets gastrin-releasing peptide (GRP) receptors. These receptors are found in lung, prostate, and breast cancer, as well as other tumors. Bracco of Milan, Italy, has initiated clinical trials in Europe and others are also investigating this class of drugs.

Increased use of alpha emitters

There is considerable research involving alpha emitters, in which the shorter particle range and high-energy deposition can be used to advantage to destroy DNA directly. A number of products in development employ bismuth-212, bismuth-213, astatine-211, and polonium-210.

One unique approach involves an in vivo generator in which lead-212 decays to bismuth-212. The parent isotope (lead-212) is targeted to disseminated melanoma tumors utilizing a melanocortin targeting agent. The in vivo use of the parent isotope allows one to deliver 10 times the energy than would otherwise be possible. The parent is chelated in an inorganic metal chelator attached to the targeting peptide. The peptide then binds to the receptor, where the entire receptor-radiolabeled peptide complex is internalized in the tumor cell. The lead-212 then decays to bismuth-212 and the bismuth produces alpha energy. Lead-212 is a mild beta emitter that goes through the system safely, reducing radiation to the kidneys. This application also has a low risk to the bone marrow because the peptide is small and most of it gets out of circulation quickly.

Importance of patient specific dosimetry

One of the limiting factors in utilizing therapeutic radiopharmaceuticals is the potential hazard to the bone marrow, kidneys, and other internal organs. The smaller peptide molecules may get out of the system rapidly but still cause damage as they pass through the various organs. The tolerable limits vary from patient to patient depending on the volume of the kidneys and other critical organs, rate of excretion, and other varying individual factors. Therefore, it is important to determine the therapeutically effective dose for each patient.

In the simplified model normally associated with regulatory approval, dosages are estimated on the basis of patient weight and physical factors rather than radiation absorbed dose. The net effect is that large safety factors are utilized to compensate for the unknowns, often resulting in dosages that are too low to be clinically effective.

With the availability of molecular imaging and PET/CT, one can determine the mean residence time of the tracer in each of the organs of interest. This allows one to examine the risk of tissue damage and select the greatest effective dose for each patient. Although a limited number of positron emitters are suitable for imaging, such as yttrium 86, I-124, and copper-64, they are becoming increasingly available.

In conventional chemotherapy, the physician often determines the dose in terms of how many times the drug is administered and how many doses the patient can tolerate. During the process, the physician tracks blood levels and known toxic reactions in the body in the heart, liver, and so on. This information is used to try and limit the side effects. However, this is more difficult with radiotherapeutic drugs that have only one infusion.

In the final analysis, treating cancer with drugs is a trial-and-error process. Some patients may respond better to one drug than another, even though superficial indications and symptoms are the same. This allows the clinician to try new therapeutic drugs in resistant cases, with the hope of producing a positive response.

The entry of new therapeutic radiopharmaceuticals in the mainstream will stimulate the development of a large array of related products targeted to many different types of tumors. Molecular imaging will be merged with therapy to obtain patient specific dosimetry for optimizing patient response and minimizing side effects. This should bring oncologists and nuclear physicians closer together, with a better understanding of nuclear medicine's potentials. With this type of market stimulus, it is likely that many more traditional pharmaceutical companies will enter the field with radioactive versions of targeted therapeutic products to enhance treatment options for many cancer patients.

By Marvin Burns

AuntMinnie.com contributing writer

June 2, 2006

Burns is president of Bio-Tech Systems, a Las Vegas-based healthcare market research company founded in 1980. The firm specializes in medical imaging and radioisotope products covering a broad range of diagnostic and therapeutic applications for strategic planning, market research, and development of new business opportunities. For further details and information, Bio-Tech can be reached at 702-456-7608 or via its Web site, www.biotechsystems.com.

Bibliography

Bio-Tech Report 230-World Market for Therapeutic Radiopharmaceuticals

Bio-Tech Report 220-Market for PET Radiopharmaceuticals and PET Imaging

Bio-Tech Report 210-U.S. Market for Diagnostic Radiopharmaceuticals

Related Reading

Therapeutic radiopharmaceutical market poised for takeoff, February 21, 2006

FDA issues draft CGMP for PET radiopharmaceuticals, September 26, 2005

Can SPECT-CT Revitalize Nuclear Medicine? July 7, 2005

Radiopharmaceuticals market to reach $3.2 billion by 2010, June 29, 2005

Changing market for PET brings challenges and opportunities, September 30, 2004

Copyright © 2006 Bio-Tech Systems