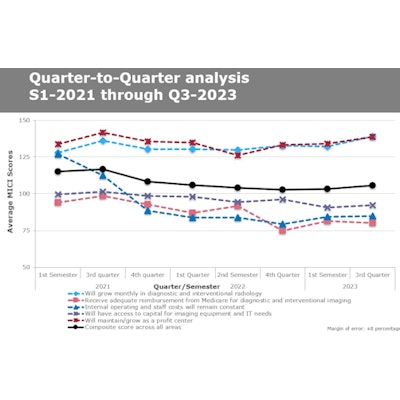

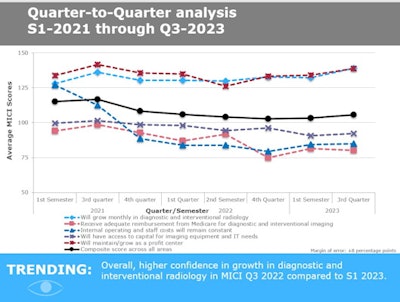

Radiology administrators are optimistic that diagnostic and interventional radiology will continue to grow as a profit center in 2023, according to MarkeTech Group's Medical Imaging Confidence Index (MICI) report for the third quarter of 2023.

They're also confident that diagnostic and interventional radiology volumes will grow monthly. However, they're less sure that their departments will have access to capital for imaging and IT needs, that internal operating expenses and staff costs will remain constant, and that their departments will receive adequate Medicare reimbursement for exams -- results comparable to MarkeTech's first-semester results.

"The political environment is uncertain," one respondent noted. "Costs are going up, labor is going up, but reimbursement is stagnant."

"Reimbursements are not [nearly] enough with the inflated costs of services, supplies, and employee salaries," another said.

MarkeTech generates the MICI report from survey responses by radiology administrators and business managers who are members of the Association for Medical Imaging Management (AHRA). The document consists of answers to questions about five trends radiology administrators face in the coming year.

This third-quarter report covered the period from July to September and included responses from 131 imaging directors and managers across the following U.S. geographic areas: 17% in the West North Central region; 15% in the East South Central region; 15% in the South Atlantic region; 15% in the West South Central region; 10% in the Pacific region; 8% in the East North Central region; and 8% in the Mountain region.

In terms of hospital/facility size, 43% of survey respondents reported 100 beds or less, 41% reported 100 to 349 beds, and 16% reported 350 beds or more.

Respondents ranked their confidence on five topics, and MarkeTech calculated a single composite score. Scores ranged from 0 to 200 and can be interpreted in this way:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

The researchers found the following:

| MICI confidence scores by topic | ||||

| Topic | Mean score 2023 semester 1 (January to June) | Interpretation | Mean score Q3 2023 (July to September) | Interpretation |

| Will maintain/grow as a profit center | 134 | Very high confidence | 139 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 132 | Very high confidence | 139 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 91 | Neutral | 92 | Neutral |

| Internal operating and staff costs will remain constant | 84 | Low confidence | 85 | Low confidence |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 81 | Low confidence | 80 | Low confidence |

| Composite score across all areas | 103 | Neutral | 106 | Neutral |

All regions except West South Central reported high confidence in growth in diagnostic/interventional radiology, the group found. The responses also showed that all regions except the Mid Atlantic, South Atlantic, Mountain, and Pacific have low or very low confidence in receiving adequate Medicare reimbursement.

The survey included a free-response section under which participants commented on the five topics. Considering study volume increases, respondents said that "we are looking at growth opportunities for cardiac dedicated CT as well as increasing interventional volumes by offering new procedures ... that ... can be done on an outpatient basis," that "operational costs will increase as procedures increase," and that "we are projecting volumes to increase along with trying to decrease expenses."

Respondents expressed concern about Medicare reimbursement, writing that "volumes have been increasing, but reimbursement and insurance denials on testing are having a major impact on profitability."

Finally, regarding operating and staff costs, survey participants noted that "internal costs [are] going up with salary increases due to staffing shortages," that "labor costs continue to be a struggle due to the use of travelers to fill staffing gaps," and that "operating costs, including staffing, have exceeded revenue."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.