Imaging procedure volume saw a strong shift from hospitals to outpatient imaging centers over a 10-year period starting in the mid-1990s, according to a new study published this month in the Journal of the American College of Radiology. But the effects of the Deficit Reduction Act (DRA) of 2005 may be giving hospitals a chance to reclaim market share in outpatient imaging.

Drs. David Levin and Vijay Rao, from the Center for Research on Utilization of Imaging Services at Thomas Jefferson University Hospital in Philadelphia, and colleagues examined recent shifts in place of service for diagnostic imaging, looking in particular to confirm whether hospitals lost business to private outpatient imaging facilities (JACR, February 2009, Vol. 6:2, pp. 96-99).

"In the mid-1990s there were a lot of outpatient imaging centers opening up, and it started to become clear that this service was shifting from hospitals to imaging centers," Rao said in an interview with AuntMinnie.com. "We were eager to track what was happening, whether there was really a shift in volume, where the growth was occurring, and why."

The researchers used nationwide Medicare Part B databases for 1996 through 2006 to calculate use rates per 1,000 Medicare beneficiaries. Using Medicare's place-of-service codes, they could determine where imaging exams had been performed -- whether in hospital inpatient, hospital outpatient, hospital emergency department, or private office settings.

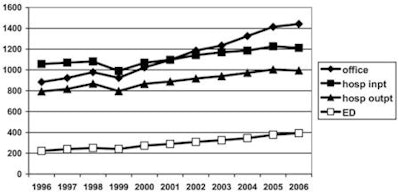

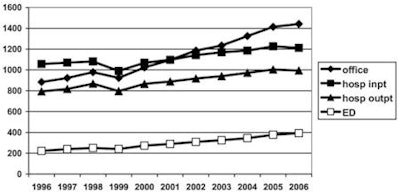

Rates per 1,000 Medicare fee-for-service beneficiaries increased in all four of these places of service during the timeframe studied. Total outpatient imaging rates (hospital outpatient plus private office) increased by 45% between 1996 and 2006, but hospitals' share of this market dropped from 47% in 1996 to 41% in 2006.

Medicare noninvasive diagnostic imaging rates per 1,000 beneficiaries in all places of service for all specialties, 1996 through 2006

|

||||||||||||||||||||||||

| Table courtesy of the American College of Radiology. |

In 1996, the private office imaging use rate was only slightly higher than the rate in hospital outpatient facilities, but 10 years later it was 45% higher.

|

| Shifts in place of service between 1996 and 2006 for Medicare noninvasive diagnostic imaging. The vertical axis shows examinations per 1,000 Medicare fee-for-service beneficiaries. Office = examinations performed in private offices or imaging centers; hosp inpt = examinations performed on hospital inpatients; hosp outpt = examinations performed in hospital outpatient facilities; and ED = examinations performed in emergency departments. Image courtesy of the American College of Radiology. |

Why the shift? One reason is that hospitals were slow to add outpatient imaging capacity, leaving the market open for entrepreneurs. Or, it may be that entrepreneurs more aggressively added new equipment to their offices and drove up demand via both marketing and self-referral.

"Hospitals tend to be capital-shy," Rao said. "They have so many demands for capital -- the surgeons want robots, an elevator needs to be fixed -- and if they don't think they have money for, say, a new PET scanner, they don't buy it. So entrepreneurs and private companies have filled the gap, using leasing arrangements to make the latest technology available to patients."

But another important factor boosting imaging growth in private offices is patient preference: many hospitals have been slow to convert their outpatient imaging practices to a truly outpatient setting, the team wrote. Entrepreneurs have created attractive centers where patients feel comfortable, and it's not surprising that patients have opted for these more pleasant and convenient office settings.

"Patients like to go to a friendly, patient-oriented place for imaging exams, where they won't get bumped off a schedule because of emergency department or inpatient emergencies and where they won't have to see sick inpatients on stretchers," Rao said.

With the 2005 DRA, which went into effect in January 2007, things have changed again. The legislation leveled the playing field, reducing reimbursement for Medicare private office outpatient imaging so that it was on par with hospital reimbursement.

With this shift, hospitals may have a new opportunity to gain market share in outpatient imaging, they wrote, but they'll need to increase their capacity and proactively market this capacity to referring physicians, patients, and health insurance providers.

"Hospitals may have missed out on outpatient imaging in the mid-1990s," Rao said. "But now there's a new opportunity to get back into the game."

By Kate Madden Yee

AuntMinnie.com staff writer

February 2, 2009

Related Reading

DRA's arrival forces imaging centers to adapt, February 1, 2007

Strategic plan, debt reduction: Proper responses to DRA, January 24, 2007

DRA 2005: The potential impact on the diagnostic imaging market, December 11, 2006

Copyright © 2009 AuntMinnie.com