In Europe, the role of PACS within the hospital has evolved over the years, and is now moving inexorably towards integration. Yesterday PACS was a departmental solution; today it is part of the enterprise. Tomorrow, PACS will provide the imaging layer of the electronic patient record.

We believe several issues will set the timeframe of such an evolution. While the IHE (Integrating the Healthcare Enterprise) initiative and HIPAA (Health Insurance Portability and Accountability Act) have a worldwide impact, they will also influence the European market.

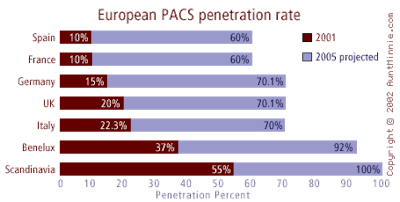

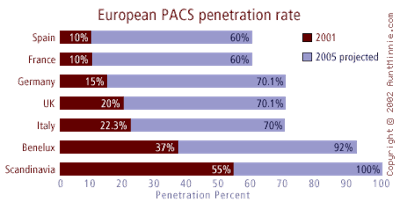

With a market size of $297.1 million (U.S.) in 2001, the European digital image management market is expected to reach around $688.2 million by 2004. Although the European sector is expected to grow at an annual rate of 25% over the next few years, we find significant differences in growth percentages between countries.

This divergence is not the result of the technology, but mainly differing levels of acceptance and hospital infrastructure. The Scandinavian market is certainly one of the leading markets in Europe due to its receptivity towards new technologies and the region's high quality of basic health services.

|

Scandinavia has the highest PACS penetration rate in Europe, and over the next three to four years Frost & Sullivan expects most of the hospitals to become filmless. Overall, a technology-driven mentality and the strong demand for sophisticated solutions are the principal factors explaining the key European role played by Scandinavia.

The United Kingdom market has experienced strong growth from the late 1990s to the present time, thanks to growing awareness of the benefits of PACS solutions. Sustained growth is also expected for the coming years as new hospitals under construction are designed to accommodate PACS networks. Frost & Sullivan believes that growth will be spread across the years during the forecast period, since the effect of the recent National Health Service (NHS) plan will take place over several years.

This NHS program provides for investment and reform aimed at improving the agency over the next 10 years. Approximately 20 new hospitals are under construction, and are being designed to employ PACS instead of film.

The Italian PACS sector has progressed significantly over the last few years as a result of the proven efficiency that PACS brings. This market will continue to grow, as customers increasingly look at issues such as RIS integration, an efficient archiving system, and user-friendly interfaces.

At the beginning of its growth phase, the Spanish market has yet to experience its largest expansion. This growth will be supported by an increasing level of investment in PACS; local authorities have increasingly been directing their budgets towards PACS. Market acceptance is being driven by declining prices, especially in archiving.

Germany is one of the most interesting markets in Europe. With relatively low PACS penetration in public hospitals, the potential is huge. Issues such as workflow and new ways to improve the image distribution process are very popular among radiologists.

The opportunity for strong growth is there, but vendors still have to face the German Strukturgesetz (Statutory Health Insurance Reform Law). This law aims at a greater level of transparency between national health insurance and the hospitals, but has currently resulted in a general slowdown of the healthcare industry, including PACS.

The French market is beset by a low installed base of imaging modalities, particularly MRI and CT. There appears to be little real demand for PACS at this time, and it seems radiologists are waiting to figure out the technology's benefits.

Influencing PACS adoption

Over the next three years, a significant number of hospitals will be taking the first steps on the road to fully digital radiology departments, and ultimately, fully digital hospitals. For vendors, the social and physiological aspect of digitizing radiology remains the key challenge.

Hospital staff will have varying levels of comfort with digital image management technology, and success will require a quick learning curve. The shorter this learning curve, the greater the benefits within the radiology department, and the greater the level of customer satisfaction. Thus, vendors need to have a strategy to reduce the existing gap between the introduction of this technology and its full acceptance.

Customization can help overcome the initial problems that radiologists have with PACS. Tailor-made PACS networks can help flatten the learning curve among radiologists, as radiologists frequently feel that they are wasting time with PACS during the first three months after installation.

Particular attention needs to be paid to organizational and departmental issues. Many technological and process issues affected by PACS involve many constituents outside the medical imaging department. Thus, an accurate investigation of factors like the information system network, the organization's culture to adapt to electronic imaging, and the ability of physicians to shift their reading practices to soft-copy review will be required.

On top of this, the workflow processes need to be examined to identify opportunities for improvement. The digital environment of modern radiology covers various systems that often require users to acquire new skill sets that are outside the scope of daily responsibilities. Therefore, training is an important tool to facilitate the transition from a film-based to a filmless environment.

Future directions

Integration with RIS is certainly a hot topic in the European market, which will experience a fusion of RIS with PACS. The gains achieved by a basic PACS are further enhanced when a bidirectional link to hospital and radiology information systems is established.

Differences across the various European markets remain as a result of the level of demand, which will continue in the short term. Another complicating factor is the sizeable installed base of non-HL7-compliant RIS systems.

In addition, there are different suppliers for PACS/RIS and HIS offerings. A few vendors market integrated PACS/RIS/HIS products, but it will take some time before an overlap will be seen between competitors of the PACS/RIS and HIS domains.

From an end user point of view, we notice a strong emphasis on archiving strategy, owing to key performance details such as image retrieval times, disaster recovery capabilities, integration of image data with text, and selection of storage media. As the amount of data produced by imaging modalities increases, the natural question becomes where to archive these images.

With regard to storage, offsite archiving has become another hot topic. The application service provider (ASP) model in particular was the buzzword at the 2000 RSNA meeting, but as yet there is no real demand for this service in Europe, except for Scandinavia. The major limiting factor appears to be the ownership of data; in other words, end users want to see what they buy. In the future, however, there will be a market segment that will move towards integration of offsite, ASP-style archiving with PACS.

Combined with available Web technology, PACS has the ability to deliver timely and efficient access to images, interpretations, and related data throughout the enterprise, thereby increasing clinician support for this technology and its value to the organization. The future of communications, business process, and information is on the Web.

A major trend in healthcare will be a massive infusion of information technology, ultimately facilitating the so-called virtual radiology continuum. In this environment, physicians will be able to order a study, schedule a study, perform a study, read and dictate a study, and distribute a study anywhere.

The technology and, in particular, the IT revolution, will be driving healthcare, as well as the PACS market. Now, end-user requirements will determine the timeframe of this process.

By Axel BaccariAuntMinnie.com contributing editor

March 21, 2002

Axel Baccari is a research analyst with Frost & Sullivan, a San Jose, CA-based market consulting and training firm. The information in this article is included in a recently published Frost & Sullivan report on the European digital image management market. For more information, visit healthcare.frost.com.

Copyright © 2002 AuntMinnie.com