Although the numbers indicate that the downturn in the PET market that began in 2006 has continued, the report also offers reasons for optimism in the near future. The reimbursement outlook is improving for many PET procedures, and the report projects the PET market to begin recovering this year and next, eventually doubling by 2016.

But first, the bad news. U.S. sales of PET scanners declined to 182 units in 2008, a decline of 17% compared with 219 scanners sold in 2007. Both amounts include refurbished systems, which are approximately half the cost of new scanners and accounted for 17% of the units ordered in 2008.

Meanwhile, PET procedure volume increased 7% in 2008 to approximately 1.8 million, including rubidium studies. That compares to 21% growth in procedure volume from 2006 to 2007.

The report also showed that technical advances have increased the average unit price of a new PET scanner to $1.8 million, with many systems above the $2 million plateau.

PET is "suffering more than it should, compared to other modalities," Bio-Tech Systems President Marvin Burns said. He believes that PET proponents have "created a mindset with the people in reimbursement and referring physicians that [PET] is a whole-body modality. That has certain advantages, but it is limiting. You can only do it once and you only get paid a marginal amount for the effort."

NOPR effect

Even with an uncertain reimbursement future and a stagnant U.S. economy, the report cited several factors that could spur a PET resurgence in the next decade, such as the U.S. Centers for Medicare and Medicaid Services' (CMS) decision in April to expand coverage of PET in several cancer areas as a result of clinically proven data generated from the National Oncologic PET Registry (NOPR).

The Bio-Tech report predicted that the PET market should begin recovering in 2009 and 2010, and by 2016 it should reach 5.4 million procedures annually and sales of approximately 360 units.

Working out overcapacity?

Several PET vendors contacted by AuntMinnie.com concurred with the report's assessment of the market.

|

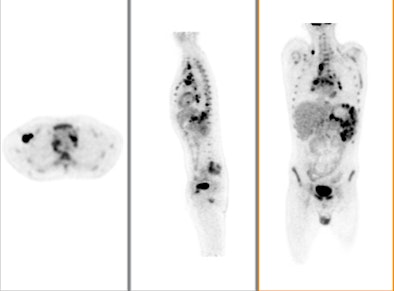

| FDG-PET/CT with integrated contrast CT shows a large tumor in the left lung with hilar lymph node metastases. Image courtesy of Siemens Healthcare and the University of Minnesota. |

Jim Mitchell, general manager for PET at GE Healthcare of Chalfont St. Giles, U.K., credited the slide in PET scanner sales to "overcapacity, where we had some early capacity buildup in 2003 and 2004."

"Procedure growth was still strong, but we had an infrastructure of PET/CT scanners that supported many more procedures," he said.

Mitchell also is encouraged that the work of NOPR will contribute to a PET market rebound. "We are encouraged by that, but we are not expecting a huge surge in the immediate growth of PET procedures as a result [of the CMS decision] until the private payors also adopt the same guidance that CMS has put out," he said.

Markus Lusser, vice president of global marketing and sales of the Molecular Imaging division at Siemens Healthcare of Malvern, PA, thinks the downturn in the PET market "has bottomed out" and there is "some light at the end of the tunnel."

He attributed his optimism, in part, to the U.S. shortage of molybendum-99, which shifted some SPECT imaging procedures to PET, and to healthcare providers investing in hybrid PET/CT systems to utilize half the system for CT-only exams, or what Siemens calls molecular CT. "In addition, more customers are using PET as a technique to follow treatment progress" of cancers, he added.

The overlap between PET and radiology certainly has been stimulated by the advent of combined PET/CT systems, the Bio-Tech report concluded. The hybrid technology also has allowed radiologists to promote the advantages of multimodality imaging to both patients and investors in PET imaging facilities.

Dominic Smith, vice president of marketing for nuclear medicine at Philips Healthcare of Andover, MA, sees the PET market as "a hybrid world [with] the clinical utilization of the accuracy of CT or MRI in the future for soft tissue, which also may be very interesting."

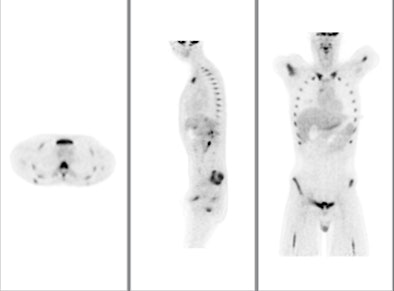

|

|

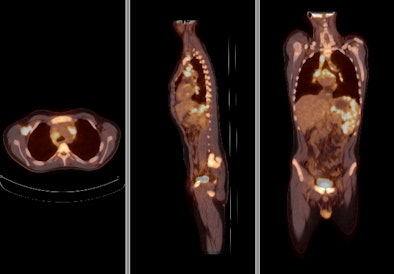

| Above, PET and PET/CT fused data post-therapy for lymphoma. Below, PET and PET/CT fused data pretherapy for lymphoma. The images illustrate a patient's lymphoma staging to assess initial treatment strategy and follow-up study after initial treatment to plan subsequent treatment. The images were taken by Philips Healthcare's Gemini TF with time-of-flight. Images courtesy of Philips and University Hospitals Case Medical Center in Cleveland. |

|

|

Perfusion agents

Although the dominant focus of PET remains in oncology, the Bio-Tech report also found that cardiology applications are increasing, including rubidium PET studies for myocardial perfusion. In addition, new PET perfusion agents are being developed for cardiology that will help expand PET's base.

"If these tracers take off, it will be great, because it will get away from this whole-body limitation," Bio-Tech Systems' Burns said. "If they can sell PET to do individual procedures like that, it will be very good."

GE's Mitchell concurs: "What we hope to see is more indications come as newer PET agents come into the market. Neurology has a promise of some additional agents coming; perhaps cardiology also will provide some additional indications with new tracers coming into the market, beyond the traditional uses of FDG and rubidium."

Those agents, however, remain in early clinical development and currently none is ready for market. "Will they come in the next 12 months or the next three years? I think is difficult to gauge right now," Mitchell said. "But certainly when they do come to the market, we would expect to see a resurgence of growth, perhaps even mid double-digit growth."

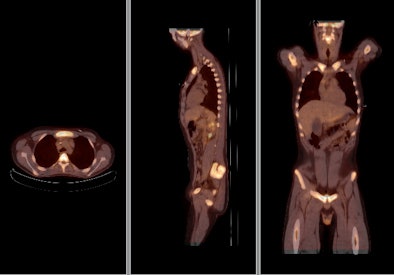

|

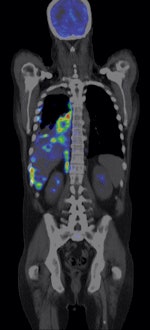

| The color PET images are overlaid on a CT scan to show the exact location and extent of disease. The image is from GE Healthcare's Discovery PET/CT 600. Image courtesy of GE and the Cancer Treatment Center of America of Tulsa, OK. |

"We are still effectively leveraging only one major agent -- FDG," Philips' Smith said. "So the technology is still in its embryonic stage. We are only using one agent and we are still at the early phase of technology development."

New oncology agents also will help in treatment monitoring and therapy planning for most common cancers, increasing the utilization of PET worldwide. In radiation oncology, Smith cited the recent installation of a PET scanner at the University of Pennsylvania, where the system is used to help in initial therapy planning and to track the progression or regression of a cancerous tumor as it responds to therapy.

Cardiac PET

One company looking to market PET for cardiac applications is Positron of Fishers, IN. The company has developed the Attrius PET scanner with its joint venture partner Neusoft Positron Medical Systems of Shenyang, China. Positron received clearance from the U.S. Food and Drug Administration (FDA) for Attrius in April and plans to market the scanner to physician and cardiology practices for less than $1 million.

Positron Chief Technology Officer Joseph Oliverio expects the first Attrius to arrive in the U.S. in late August or early September. It then will be tested at the Heart Center of Niagara-Niagara Falls Memorial Medical Center in New York.

Oliverio believes cardiac PET will garner more attention with increasing reimbursement for the procedure. The reimbursement fee in 2009 is $1,156, and the proposed rate from CMS for cardiac PET in 2010 is $1,429, an increase of 23%.

Equipment financing

What is a concern is how long the current recession will constrain the willingness of banks and other lenders to provide financing for hospitals and physician practices. "However, these larger cardiology groups, in my opinion, are strong financially, and I don't believe they will have a difficult time obtaining financing for these medical devices," Oliverio said.

For now, it appears that Positron will have little competition. Siemens' Lusser believes that the major imaging vendors will not enter that segment of the PET market, because the return on a PET-only product line would not substantiate the investment.

"Despite the fact that it probably would be half the cost of a normal PET scanner, will you be able to build up a sustainable business model or the ability to do other studies to substantiate a return [on the purchase]?" Lusser added. "That's why we see the sustainable trend toward hybrid scanners."

In other report findings, international orders declined approximately 7% in 2008 compared to 2007. Orders for PET scanners also increased from remote parts of the world that previously lacked the technological expertise to pursue PET.

Growth of the international market should help cushion the downturn in the U.S. for PET manufacturers, and by 2016 worldwide orders should reach approximately 900 units.

By Wayne Forrest

AuntMinnie.com staff writer

August 13, 2009

Related Reading

PET procedures grow as sales fall, July 17, 2008

U.S. contrast market set to double by 2013, March 22, 2007

New growth for diagnostic radiopharmaceuticals, November 9, 2006

Radiopharma market expected to double by 2012, October 10, 2006

PET market continues double-digit growth, June 9, 2006

Copyright © 2009 AuntMinnie.com