The supply of healthcare today is directly affected by our care delivery systems. Hospitals have been working hard to meet the demand caused by the COVID-19 pandemic while preserving resources needed for safety.

Rebecca Farrington from Healthcare Administrative Partners.

Rebecca Farrington from Healthcare Administrative Partners.Additionally, in order to do their part in lessening the spread, healthcare providers have had to quickly adapt to meet precautionary measures and reduce nonurgent and elective care. These steps have had many downstream effects and have proven financially devastating for many medical specialties, including radiology.

Radiology practices across the country have been experiencing a decline in business in the range of 50%-70% since mid-March, when many of our most populous states began issuing shelter-in-place orders, according to the RSNA.

Outpatient imaging has experienced the most abrupt decrease, nearly 70%, with a large percentage of elective procedures such as screening mammography and dual-energy x-ray absorptiometry (DEXA) being postponed until late May and beyond. With more emergent studies continuing to take place at inpatient imaging facilities, the volume decrease in hospitals has been less substantial, hovering around the 50% level.

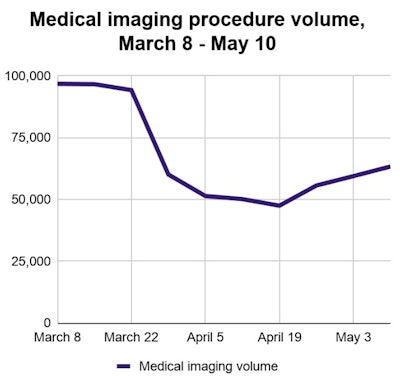

This story is consistent with what we are seeing among our client base, which is comprised mainly of independent hospital-based imaging and outpatient imaging groups. The information shown in the graph below is our aggregated client volume trend beginning in early March.

We saw our largest one-week dip occur in the week of March 29 as stay-at-home orders were expanded and health systems reached peak crisis mode.

We are hopeful that the industry as a whole has seen a bottoming out as of the week of April 19. That is when our volume reached its lowest threshold, down 60% from our historical weekly averages. We are pleased to see volume trending upward since April 26, but it still remains down 50% from our historical averages through the first week of May.

Radiology rebound?

The overall economy could remain suppressed as businesses begin to reopen, but demand for most imaging services should rebound above historical baseline levels as patients begin to reschedule necessary imaging that has been deferred. The extent of this imaging rebound and the eventual future state of imaging volume are of course unknowable.

There are many questions about how requirements for routine medical imaging may change and how the pandemic will affect physician referral ordering patterns over the longer term. Much of the rebound will hinge on the patients' response and their comfort level with returning to the imaging facility. We also expect that we will see a rise in the need for imaging and hospital visits as people resume their normal day-to-day activities.

A survey conducted by IMV Medical Information Division in April showed that over half of the respondents anticipated a return to normal patient volume in two to three months. Nearly 25% of the respondents had a less optimistic outlook, expecting the rebound to take more than four months.

Our perspective is that much of radiology's rebound will be very geographically driven, but we are optimistic that we will see significant improvement over the course of the next few months. The phased reopening approach outlined by the federal government will drive quicker response in areas with less disease density and will also be impacted by each governor's interpretation of the reopening plans.

Addressing issues of hospital capacity and the need to shift care to critical patients will remain a primary focus of health systems, so if resource needs increase with additional waves of patients with COVID-19, more elective procedures could be further delayed. Healthcare providers will also need to ensure that their supplies of personal protective equipment (PPE) are adequate for the increasing elective procedure volume.

Conclusion

While much of the returning volume will be driven by national and state policy, we are preparing to help provide guidance on what an individual practice can control in order to approach full volume as soon as possible while also keeping your patients and staff safe. We conducted an informal survey that indicates a lot of uncertainty remains around two critical areas that will drive volume: marketing plans and recapturing patients that were lost during the lockdown period.

Rebecca Farrington serves as the chief revenue officer for Healthcare Administrative Partners. She has more than 20 years of experience in healthcare sales and management roles, focusing on hospital-based and physician revenue cycle management.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com.