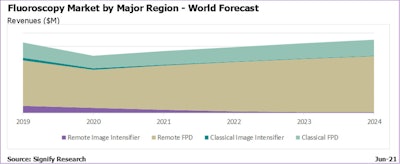

The fixed digital radiography market is expected to grow at 10% year-on-year in 2021, reaching $1.1 billion, while the fluoroscopy market will also experience good levels of growth at 8%, closing 2021 at $463.2 million.

These figures, taken from Signify Research's "General Radiography & Fluoroscopy-- World 2021" report, show an encouraging rebound after a challenging 2020, during the COVID-19 pandemic.

Demand switches from mobile to fixed radiography in 2021

The general radiography market grew by 12% in 2020, due to the exceptional demand for mobile radiography systems. The world market for mobile radiography systems is estimated to have increased by an impressive 77% year-on-year.

Mobile digital radiography (DR) systems are at the forefront in providing initial screening for pneumonia, a secondary and more progressive stage of COVID-19 in severe cases. Mobile DR systems are also used to track progression of pneumonia due to the capabilities of bedside imaging, enabling their use in emergency rooms, accident and emergency facilities, and in the intensive care unit.

During the peaks of the COVID-19 pandemic, hospitals and healthcare facilities around the world were desperately attempting to procure mobile radiography systems to supplement existing inventory in the face of supply shortages at most of the leading vendors.

As healthcare facilities rapidly sought out mobile systems, often discarding brand loyalty for whatever systems were available, budgets were diverted away from fixed radiography systems and fluoroscopy systems. The fixed digital radiography (DR) market declined by 14% year-on-year in 2020. In unit terms, 11% fewer fixed DR systems were sold in 2020.

As the pandemic begins to subside and healthcare budgets gradually return, investment in the fixed general radiography market is projected to return to prepandemic levels by the end of 2021.

On the contrary, the global market for mobile radiography systems is projected to finish with a sharp decline of 39% in 2021. With most hospitals and health clinics having recently purchased mobile radiography systems during the pandemic, the inflated installed base will restrict the need for new systems in the coming years. The market is forecast to return to growth in 2023, driven by the replacement of older analog systems.

Stronger growth forecast in multipurpose fluoroscopy

The fluoroscopy market experienced a challenging year in 2020. With fluoroscopy budgets diverted to COVID-19 response, alongside fewer fluoroscopy procedures, the market saw a 19% decline in revenue.

Clinical demand is shifting away from fluoroscopy to CT and endoscopy, further threatening this market. The main procedures that remain a stronghold for fluoroscopy include barium-swallow scans and upper gastrointestinal procedures.

Stronger growth is forecast for multipurpose systems that can perform both radiography and fluoroscopy, due to wider clinical usage and associated higher return on investment. After the steep decline in 2020, the fluoroscopy market is expected to gradually recover and surpass 2019 revenue levels by 2024.

Key trends by region

North America

- Unlike most other world regions, North America -- and in particular the U.S. -- remains a classical fluoroscopy market, with far lower uptake of remote imaging, due to the associated detachment from the patient and concerns of jeopardizing image quality and subsequent litigation.

- Brand loyalty continues to be strong for general radiography equipment, to prevent retraining and adjustment of workflows.

Latin America

- Demand for analog and computed radiography systems remains high in Latin America, with the lower prices being a key deciding factor. In Brazil, it is estimated that 85% of general radiography exams are still conducted on analog systems, a far higher number than many other emerging countries. However, with falling prices of flat-panel detectors, digitization is expected to gather pace in the coming years.

- Fluoroscopy remains a small market in Latin America due to the relatively high system prices yet lower utilization due to the niche clinical applications they address. The shortage of trained radiographers is also holding back the fluoroscopy market.

Western Europe

- The general radiography market in Western Europe continues to remain focused in the higher-end market segment, especially floor-mounted systems.

- Fluoroscopy continues to be a very small market in most Western European countries, with France being the exception, where the market for remote systems is forecast to increase over the coming years. France is unique in that hospitals use fluoroscopy for patient positioning and to localize where to start imaging, and this modality is therefore used frequently. Additionally, there is a strong replacement market and older systems are typically replaced like-for-like and not with a multipurpose system. Most other Western European countries have much less uptake of dedicated fluoroscopy equipment.

Eastern Europe, Middle East, and Africa

- Lower-cost analog solutions continue to sell well in the African general radiography market. In Eastern Europe there remains a focus on floor-mounted digital x-ray solutions, as the lower price point is a key factor in this price-sensitive market.

- French-speaking parts of North Africa still have a strong demand for fluoroscopy systems, following France in this trend. Elsewhere, demand remains lower.

Asia Pacific

- The fluoroscopy market is largest in China and Japan, with all other Asian countries having very limited uptake, as other modalities are favored for traditional fluoroscopy procedures.

- Lower-cost floor-mounted systems continue to dominate the general radiography market, especially in China.

Competitive analysis

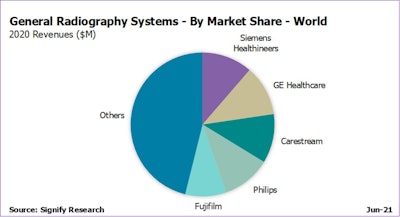

In 2020, Carestream consolidated its position as mobile DR market leader, followed by GE Healthcare, Siemens Healthineers, Philips, and Fujifilm.

Siemens Healthineers and GE Healthcare secured the position of joint market leaders in the fixed DR market, with GE Healthcare gaining significant share in 2020.

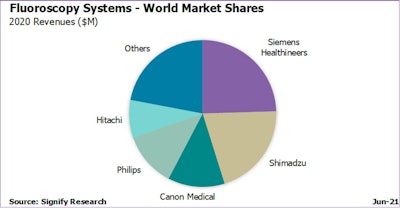

Siemens Healthineers was the world market leader for fluoroscopy in 2020, with Shimadzu, Canon Medical and Philips following.

Future outlook

The fixed DR market will rebound in 2021, as budgets and investment will return to fixed radiography rooms. Signify Research forecasts investment will gradually return for high-end DR solutions, such as ceiling-suspended and multidetector systems from 2021 onward.

Growth in the low-end fixed DR market is forecast to primarily come from emerging regions, such as Africa, Latin America, and Asia, where there is a significant installed base of analog radiography and computed radiography ready for digitization. Growth in the fluoroscopy market will be limited as clinical procedures move from fluoroscopy to CT or endoscopy.

As a result of increased focus on cost-efficient solutions and return on investment, most of the demand for fluoroscopy equipment will be captured by multipurpose systems capable of performing general radiography procedures.

Graham Cooke is a marketing analyst at Signify Research. These statistics and analysis are taken from Signify Research's General Radiography & Fluoroscopy -- World 2021 report.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com.