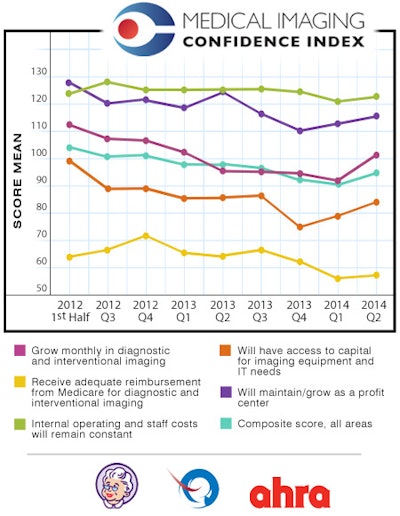

After multiple quarters of bleak sentiment, radiology administrators appear to be showing signs of "guarded optimism" in their future business prospects, according to new data from the Medical Imaging Confidence Index (MICI) for the second quarter of 2014.

Each of the index's five elements showed upward growth in the quarter, as did its composite score. While some of the changes aren't statistically significant compared to earlier numbers, there are bright spots that do reach significance, according to Christian Renaudin, PhD, founder and CEO of the MarkeTech Group, which conducted the survey of imaging directors and managers who are members of the AHRA medical imaging management association.

"We cannot say overall across all indicators that things are getting better," Renaudin said. "We are still below [sentiment in 2011-2012] as of today, but there are some elements of recovery and there are some reasons to be a little bit more optimistic than we were last year."

Forward-looking index

MICI is a forward-looking index designed to provide an early view of trends as they develop. It is derived from the responses of 158 imaging directors and hospital managers, who were asked about five key trends typically encountered by radiology administrators.

MICI gathered survey participants from across the U.S., with 10% based in the Pacific region, 8% in the Mountain region, 11% in the West North Central region, 20% in the East North Central region, 15% in the Mid-Atlantic region, 20% in the South Atlantic region, 8% in the East South Central region, and 8% in the West South Central region.

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also tabulated. Scores range from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

As in past surveys, radiology administrators expressed the least amount of confidence that they would receive adequate Medicare reimbursement; this indicator was the lowest of the five individual MICI questions, with a score of 58. At the other end of the scale, administrators expressed the most confidence that they would be able to keep internal and staff costs constant, with a score of 122.

Making a sharp recovery was confidence in the ability to grow diagnostic imaging and interventional volume, with a score of 101, compared with a score of 92 in the first quarter of 2014. The change is statistically significant, Renaudin said.

Also, sentiments about access to adequate capital are improving, especially among midsized hospitals of 100 to 299 beds, while smaller hospitals are becoming more confident in their ability to grow procedure volume.

As a general rule, the MICI indicators are higher in areas where radiology managers feel they have control, according to Ed Cronin, executive director of AHRA.

"They feel they can control their labor and operating costs; they can control somewhat their volume," Cronin said. "[For] the things that they can't control -- the reimbursement rates and, in some respects, the capital availability -- they have lower confidence."

That sentiment was echoed by Joseph Mikoni, director of laboratory and imaging services at Boulder Community Hospital in Colorado. Radiology administrators have a number of tools at their disposal to contain costs, such as shortening business hours, cutting service lines that have lower volumes and are duplicated in the community, or even cross-training personnel to enable them to cover more than one modality during slower periods, he said.

"We've really had to take a harder look at our costs and figure out what we can save on," Mikoni said. "As you're really trying to contain your costs, you look closer at utilization, and sometimes where you can save money is, maybe it's not a 10-hour day at a clinic, maybe it's an eight-hour day."

The second-quarter MICI numbers are the subject of the Google Hangout below between Cronin, Renaudin, Mikoni, and Brian Casey, AuntMinnie.com's editor in chief.

Road to recovery?

Do the Q2 numbers indicate that radiology has turned a corner toward recovery?

Cronin said he expects the positive sentiment to continue, but there is still a lot of uncertainty in the market with respect to the Affordable Care Act, the upcoming midterm elections, and other issues, so most of the MICI indicators should remain consistent in upcoming surveys.

Both Renaudin and Mikoni said they believe the recovering market should put radiology managers in a better position when negotiating with hospital administrators over new equipment purchases. With an aging installed base of equipment, new scanners are needed to achieve throughput goals and meet growing volume levels, Renaudin pointed out, a process that is already underway at Boulder Community Hospital, Mikoni confirmed.

"Things are changing, but they are changing over time," Mikoni said. "This has been a very strong first quarter for us also, and we are seeing some reason for optimism, but it's guarded, because we know there are many changes on the horizon."