The number of newly diagnosed cancers continues to increase, presenting a major health concern for the worldwide population. Over the past two years, newly diagnosed patients receiving radiation treatments increased 16%, according to the new radiation oncology report by market research firm IMV Information Medical Division. Early detection, personalized strategies for optimal care, and advancing technology continues to drive the market for better equipment.

In 2021, 1,071,000 cancer patients will be treated in the U.S. with radiation therapy, according to IMV's newly published "2021 Radiation Therapy Market Summary Report." The use of radiation therapy to treat cancer patients has been relatively stable, with the estimated number of patients increasing at an average annual rate of 1%.

As the radiation therapy market remains relatively stable, with technology developments many facilities plan to increase their capital budget for new and updated equipment in future years. The radiation therapy equipment types with the highest purchase interest from 2020 to 2022 are external-beam systems in 48% of the facilities surveyed, followed by image-guided radiotherapy (IGRT) in 39% of the treatment sites.

IMV's 2021 Radiation Therapy Market Summary Report is based on interviews with respondents from 501 radiation therapy departments/facilities who participated in IMV's nationwide survey in August 2020-July 2021. The results are projected to the universe of 2,253 hospitals and nonhospitals that perform radiation therapy in the U.S.

Based on the survey participants, many sites continue to invest in new and replacement equipment. Over two-thirds of radiation therapy sites reported they had capital budgets for radiation therapy equipment in 2020 compared with sites that did not have capital budgets.

In the upcoming years, a higher percentage of sites in this survey (18%) are planning to have budgets of $2 million or more for radiation therapy (RT) equipment in 2022 compared with 13% in 2020.

| Radiation therapy capital equipment budget trend from 2020 to 2022 | ||

| Projected 2022 budgets | 2020 | 2022 |

| Percent of sites planning zero-dollar budgets on capital purchases | 33% | 28% |

| Percent of sites planning $2 million or more on capital purchases | 13% | 18% |

The 2021 IMV report provides a department-wide view of the key radiation therapy technologies used to treat cancer patients, including external-beam radiation therapy equipment, IGRT, brachytherapy equipment, treatment planning systems, simulators (x-ray, CT, PET, MRI) and oncology information systems.

External-beam radiography

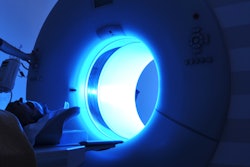

Radiation therapy treatments using external-beam radiography technology include linear accelerators and Gamma Knife, CyberKnife, TomoTherapy systems, as well as the newest technique, proton therapy.

Over half of the hospitals surveyed in the U.S. have external-beam therapy equipment installed in their facility. Key manufacturers include Varian, Elekta (including Gamma Knife systems), and Accuray (which acquired TomoTherapy). Siemens Healthineers has reentered the radiation therapy market and acquired Varian Medical Systems in April 2021.

Image-guided radiotherapy

The use of real-time imaging technology to guide radiation therapy treatments has significantly increased to over 95% of radiation therapy sites. The top three types of image-guidance systems used are CT or conebeam CT, electronic portal imaging devices, and x-ray. CT continues to be the most preferred modality by those planning IGRT purchases. The key manufacturers include Accuray, Elekta, Varian, Brainlab, and Vision RT.

Brachytherapy

Brachytherapy is a form of radiation therapy where a capsule with a radiation source is implanted near the tumor to treat cancer. Almost half of IMV's 2020/21 survey respondents reported they have brachytherapy systems installed, including either remote after loaders or electronic brachytherapy equipment. Key manufactures of equipment include Elekta, Varian, and Xoft.

Treatment planning

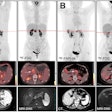

For treatment planning, virtually all radiation sites reported using CT images in some portion of their treatment plans. However, due to PET's ability to reveal metabolic activity and changes in tumor cells, the use of PET in treatment planning has increased over the past decade and continues to be a preferred option of treatment plans.

In addition, the use of MRI technology to identify tumors without the use of ionizing radiation increased over the past 10 years and remains a relatively stable in-patient treatment plan. Top manufacturers for treatment planning equipment include Varian, RaySearch, Accuray, Elekta, Philips, and Brainlab.

Treatment simulators

Before a patient begins their radiation therapy, healthcare treatment plans are simulated using hardware and software applications. CT simulation has replaced x-ray imaging and is used in the majority of equipment.

The key providers of simulator hardware include Canon Medical Systems, Philips, GE Healthcare, and Siemens Healthineers. Overall, PET/CT simulators installed base has gradually increased in the past five years but slightly declined in 2021. Meanwhile, x-ray simulators have declined commensurately to 1%.

Record-and-verify oncology information systems

Virtually all facilities have a record-and-verify oncology information system installed across all site types. The data types available on systems include scheduling capabilities, images, electronic medical records (EMR), and billing records. Key information system manufacturers used by radiation therapy sites include Varian, Elekta, Accuray, and Siemens Healthineers.

IMV's 2021 Radiation Therapy Market Summary Report provides a department-wide view of the key radiation therapy technologies used in treating cancer patients, including external beam therapy equipment, image-guided radiotherapy (IGRT), brachytherapy equipment, treatment planning systems, simulators (x-ray, CT, PET, and MRI), and oncology information systems. This report monitors trends over the past decade in the top cancer types treated with radiation, patient volume, installed equipment, market share, and technology adoption rates, as well as the future for acquiring and using such technologies.

The data source for this report is IMV's 2020/21 Radiation Therapy Census Database, which provides comprehensive profiles of hospital and nonhospital sites performing radiation therapy in the United States. This database can be separately licensed by qualified subscribers.

For information about purchasing IMV's 2021 Radiation Therapy Market Summary Report or IMV's 2020/21 Radiation Therapy Census Database, visit the corporate website at www.imvinfo.com or call 773-778-3080 to speak with a representative.

Disclosure: IMV Medical Information Division is a sister company of AuntMinnie.com.