There was a 1.1% drop in imaging volume per Medicare beneficiary in 2014, according to new figures released by the Medicare Payment Advisory Commission (MedPAC). Much of the change has been fueled by a shift of cardiac imaging from private practices to hospital outpatient departments.

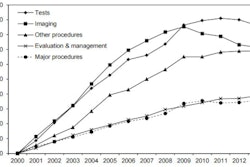

The findings come from MedPAC's March 2016 "Report to the Congress: Medicare Payment Policy" and reflect other reports in recent years that have documented a decline in imaging volume. However, MedPAC again pointed to overall growth in imaging services since 2000 as an indication that imaging payments should be closely watched.

In 2014 compared with 2013, the number of echocardiograms per beneficiary provided in hospital outpatient departments went up by 7%, while the number provided in professional offices decreased by 5.7%. During the same period, the number of nuclear cardiology studies per beneficiary provided in hospital outpatient departments increased by 1.1%, while those provided in freestanding offices declined by 9.6%. These changes are in line with an increase in hospital-owned cardiology practices, according to MedPAC.

"Evidence indicates that volume decreases may be related to the movement of services from freestanding offices to hospitals, general practice pattern changes, and concerns about overuse of imaging and tests," MedPAC wrote.

The commission acknowledged the decline in Medicare imaging volume, but it also emphasized that overall cumulative growth in imaging volume from 2000 to 2009 totaled 85%, compared with a cumulative decrease in imaging volume since then of about 9%.

"The growth in imaging volume from 2000 to 2009 was exceeded only by the 86% growth in the use of tests (e.g., allergy tests) during those years," MedPAC wrote.

| Changes in Medicare imaging volume | |

| Avg. annual change in units of service per beneficiary, 2009-2013 | -0.9% |

| Change in units of service per beneficiary, 2013-2014 | -1% |

| Avg. annual change in volume per beneficiary, 2009-2013 | -2.3% |

| Change in volume per beneficiary, 2013-2014 | -1.1% |

| Percent of 2014 allowed charges | 11% |

Low value?

Imaging and cancer screening measures comprise about 70% of the volume of low-value care per 100 beneficiaries -- that is, services that have little or no clinical benefit, or care in which the risk of harm outweighs the potential benefit -- according to MedPAC's report.

The commission cited research from 2014 that listed 26 low-value medical procedures, including a dozen imaging exams. For the current report to Congress, MedPAC applied algorithms from the study to Medicare claims data from 2012.

"In addition to increasing healthcare spending, low-value care has the potential to harm patients by exposing them to risks of injury from inappropriate tests or procedures and may lead to a cascade of additional services that contain risks but provide little or no benefit," MedPAC wrote.

Primary care is undervalued ...

The report also included a look at disparities in physician compensation, which are widest when primary care providers are compared with radiologists and nonsurgical, procedural specialists. MedPAC found that radiologists earn twice as much as primary care physicians: In 2014, radiologists earned on average $518,000 per year, while primary care doctors earned $264,000.

The nature of the physician fee schedule and its reliance on fee-for-service (FFS) medicine leads to an undervaluing of primary care and an overvaluing of specialty care, MedPAC said.

"FFS payment allows some specialties to more easily increase the volume of services they provide (and therefore their revenue from Medicare)," the group wrote.

... and the SGR is gone

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA), repealing the sustainable growth rate (SGR) formula, which had been used to limit fee schedule spending growth. The bill mandates a 5% payment increase for fee-for-service clinicians through 2019; potential, additional fee adjustments -- either positive or negative -- will begin in 2019 and will depend on physicians' participation in the U.S. Centers for Medicare and Medicaid Services (CMS) merit-based incentive payment program.

Overall, physician reimbursement is sufficient, MedPAC concluded.

"The evidence suggests that payments for physicians and other health professionals are adequate," it wrote. "Therefore, the commission recommends an update for 2017 consistent with current law."