The growing acceptance of PET/CT as an essential part of oncology services has helped increase its use in step with the hybrid modality's expanding installed base, according to a new report on PET/CT and PET market conditions.

The analysis by IMV Medical Information Division found that 1.85 million PET and PET/CT procedures were performed in the U.S. in 2011, a 6% increase from 2010. On the other hand, utilization per site rose only 0.6% last year, according to Lorna Young, senior director of market research at IMV. The findings were based on telephone surveys with managers at one-third of the 2,210 PET imaging services in U.S.

"We observed flat use at sites, but growth in the number of sites that are performing PET," Young told AuntMinnie.com.

The 6% increase indicates that demand for PET is still growing, but the finding also reflects slower growth more recently. Surveys conducted by IMV in 2005 and 2008 found average annual growth rates of about 10%, she noted.

Hospitals continue to open new cancer treatment centers in anticipation of increased demand and the generally lucrative nature of the services. PET/CT is still fairly well reimbursed and has become a standard component of comprehensive oncology services, Young said.

The report identified 1,130 PET/CT sites equipped with at least one fixed PET/CT scanner. A total of 100 fixed dedicated PET sites with at least one PET system were operational last year, along with 980 mobile PET/CT and PET services.

Mobile services were most popular with 200-bed or smaller hospitals. A majority of hospitals with fewer than 400 beds provided mobile PET/CT if they offered the image modality at all.

Mobile PET can be viewed as an incubator for future fixed-site sales, according to Young. "Therein lays the promise for future markets," she said.

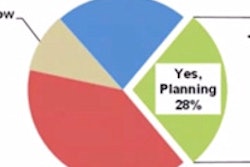

Fourteen percent of PET and PET/CT users plan to purchase a new system in the next three years, according to the report.

Oncology dominates

PET/CT utilization trends illustrate how thoroughly oncology dominates the field. Approximately 94% of PET procedures in 2011 were related to cancer assessment. The other 6% were evenly divided between cardiology and neurology.

Oncology's market share has actually grown, from 86% of total PET and PET/CT procedures in 2001 to 95% in 2010. In 2011, 38% of the oncology volume was associated with cancer staging, another 13% was used for treatment planning, and 30% pertained to suspected recurrence and therapy follow-up.

F-18 FDG remains the mainstay of PET/CT, as about 95% of all clinical PET procedures are performed with the radiopharmaceutical, according to the report. In cardiology, rubidium-82 and nitrogen-13 ammonia are both employed for PET myocardial perfusion imaging. In neurology, the U.S. Food and Drug Administration's (FDA) approval of F-18 florbetapir (Amyvid, Eli Lilly) for beta-amyloid plaque brain imaging in April 2012 may lead to greater demand for PET for diagnosing and monitoring Alzheimer's disease and other forms of cognitive degeneration, the report noted.

Data for IMV Medical Information Division's "2012 PET Imaging Market Summary Report" was drawn from telephone surveys of 738 facilities selected from a universe of 2,210 known fixed-site and mobile PET and PET/CT services in the U.S. The surveys were conducted from April 1, 2011, to May 31, 2012.

Responses were projected to create a statistically valid of profile of PET and PET/CT service experiences as a whole.

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.