When digital radiography (DR) systems began hitting the market in the late 1990s, the technology's lofty price tag put DR on more healthcare institutions' "wish" lists than "buy" sheets. A healthy degree of fiscal and clinical caution as to how long it would take hospitals to recover their investments -- and whether DR's image quality was worth the money -- also tempered DR's launch.

Now, industry observers concur that DR's best days are still ahead. The market is growing and is nowhere near saturation; the recent decline in system prices is prompting more interest among imaging facilities of all sizes; and realized workflow and productivity gains have proved that DR is worth the investment ... eventually.

By no means, however, is purchasing DR an assurance of instant radiological success. Among the caveats, radiology departments, imaging centers, and office-based physician practices must have enough patient volume to recoup the six-figure investment in a reasonable amount of time.

Today's market

As of early 2006, there were an estimated 16,500 general x-ray units installed in general hospitals in the U.S., according to an upcoming publication, "2005/06 General Radiography/DR/CR Market Summary Report," by market research firm IMV Medical Information Division of Des Plaines, IL. Of these, about 80% are conventional units and 20% are DR units.

The report indicates that there is an ongoing shift from conventional x-ray systems to DR, with DR units making up half of total radiography sales in 2005, compared to one-third of total sales in 2003. Some two-thirds of planned radiography purchases will be digital, according to the report. From 2003 to 2005, an estimated 1,200 to 1,300 general x-ray units have been installed each year nationwide in U.S. hospitals.

While the purchase prices for DR systems may not be declining as dramatically or as rapidly as healthcare providers may like, DR is sliding toward a more affordable level where imaging centers and private-practice groups can crunch some numbers on the feasibility of going digital.

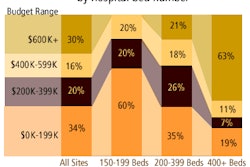

Depending on options and functionality, DR systems can range from $225,000 to more than $500,000. High-end, two-panel DR systems that touched the $700,000 plateau a few years ago may be had today for $550,000, a discount of 20%. Some CCD-based DR systems are below the $200,000 mark, due to the sharp price drop of CCD chips, which account for approximately one-third of a system's cost.

While the price of DR and its return on investment are major considerations, working in its favor are workflow improvements, greater patient throughput, and making the most of available space, all of which are becoming greater priorities for healthcare providers. Also critical is the need for hospitals to move their radiography studies into a PACS network as facilities advance toward electronic medical records.

Economics of DR

If patient volume is available in large enough numbers, the economics of DR are clear. DR allows high-volume hospitals and imaging centers to double productivity, in many cases, performing as many procedures in half the number of rooms or with less staff.

That economic rule of thumb worked for Dallas-based Radiologix, which began last year to assess the technology needs of its 70 imaging centers in the U.S. in parallel with the deployment of a common RIS and PACS platform among the company's practices.

While price is important, Vickie Bedel, national director of clinical operations for Radiologix, placed it at the bottom of the company's priority list when evaluating the purchase of DR. "In my opinion, many of us can get through that (investment in DR) when we concentrate on the clinical applications, workflow, benefits to the patient, and long-term vision," she said. "We believe that unless you eliminate one of your radiographic rooms to put in a full DR room -- or go from three to one -- you're not getting the return on your investment. If we weren't able to do that, we stuck with CR."

One of Radiologix's East Coast practices reduced its number of radiographic rooms from four to two, and, at the same time, decreased its patient wait time by 50%. Patient wait time was calculated from when a patient entered the imaging center to when a radiologist created the patient's report for the referring physician. The practice also took advantage of the newfound space to expand its ultrasound services to one of the rooms.

Productivity gains

Trillium Imaging in Toronto has four imaging centers, all of which replaced conventional x-ray rooms with DR systems earlier this year. Like many imaging providers, the DR conversion was driven by the desire for greater technologist productivity and to provide digital images for a PACS.

While Trillium has yet to conduct a formal study on the impact of DR since installation, managing director Dr. Murray H. Miller has no doubt that there have been productivity gains. Trillium's patient volume of approximately 200 exams per day has not changed since the installation of DR, because Trillium images every patient that comes in the door, but Miller said DR has reduced the amount of time radiologists spend on office work. Having DR images for storage in the hospital's PACS also removes the need to send film from one imaging center to another by courier, eliminating what Miller described as "hours of delays."

"If you're in the imaging business, I think it only make sense to do DR these days," Miller said. "The only time it (CR) makes sense is when you have a very-low-volume facility where you already have the x-ray infrastructure and you want to convert it to digital."

As for clinical benefits, radiologists can manipulate images and reduce repeat exposures with DR. "If there is a suboptimum exposure, we can compensate for it," Miller said. "There also is a small reduction in dose with DR. The reduction in dose for the patient comes, in part, from the fewer number of repeat images."

Patient volume

Not every facility has the patient volume of a Radiologix or a Trillium. Alliance Community Hospital in Alliance, OH, is licensed for 204 beds and has an additional 78 home and transitional beds in an attached long-term care facility. Alliance performs some 30,000 diagnostic radiology procedures annually, which is down from 39,000 six years ago due, in part, to competition from nearby imaging centers and physician offices with radiology capabilities.

Given that level of patient volume, chief technology officer David Shroades said Alliance has to balance its costs of operations while providing "the best technology for our community."

When Alliance moved to its new facility in January, the hospital added DR technology with a general-purpose radiography room and flat-panel detector to complement new and existing CR capabilities. While Alliance would have preferred to go digital in its ER instead of adding CR, Shroades said it was a question of not having the capital to do it.

"We can do more patients (with DR)," he said, "but if we don't have the volume to justify it, then I would stick with CR, because it is very cost-affordable. It isn't like we are not digital; images are available to send anywhere at anytime" with CR and DR.

In evaluating costs versus benefits, Shroades estimated the cost of a single-plate DR room at $300,000 and an analog room with a CR unit in the range of $170,000. While the analog CR room would not be as fast or able to handle the same number of patients as the DR room in a given amount of time, patient throughput is not an issue with Alliance.

"Would it be more efficient for the patient, if we were digital? That's what we have to evaluate," Shroades said. "In an ER setting, are we hindering a patient's care by not being digital? I don't think anyone is even remotely considering that we are, because we are not a level I trauma unit. If we had 50% more volume, we would have to have DR."

Service costs also must be calculated in a long-term DR investment. Shroades figured the annual cost of service for a single-plate DR room to be in the range of $20,000, compared with approximately $35,000 annually for a dual-plate DR setup. An annual service contract for an analog CR room would be approximately $15,000.

DR and CR coexist

Facilities that utilize a combination of DR and CR in the clinical setting have become the rule, rather than exception. With a wall stand or table configuration, DR will image more fixed positions in a shorter amount of time, while CR's portability is more valuable in a trauma unit or emergency room for immobile patients.

There is no debate that DR is faster than CR, but even high-volume facilities have a broad enough range of patients in their ER or imaging departments that CR has become a complementary technology to DR -- and can serve as a low-cost, standalone technology in a low-volume facility.

When McKay-Dee Hospital Center in Ogden, UT, moved to its current location in March 2002, the facility transitioned from film to digital. One of 22 hospitals in the Salt Lake City-based Intermountain Healthcare chain, McKay-Dee handles approximately 120,000 radiology exams annually. The 275-bed facility has six DR units, three of which are table-upright systems. Two of the upright units handle some 40 to 50 outpatient studies per day, while the other four DR units are in the ER and radiology suite. McKay-Dee also has one multiplate CR reader and four solo CR units in its NICU, ICU, OR, and ER.

With DR performing approximately 90% of the radiography exams at the facility, CR covers the remainder when technicians need flexibility in cases in which a patient can't stand or is immobile.

DR alone has helped McKay-Dee accommodate a 10% increase in general radiographic exams over the last four years with the addition of only two full-time radiologic technologist positions. The hospital also was able to reduce its clerical staff in radiology -- schedulers, record keepers, and receptionists -- from 30 to 17 people, in part, because of less paperwork.

The time it takes to perform a hand x-ray using conventional film-based radiography was eight to 10 minutes. Now, with DR, the same scan takes about two to three minutes. "It literally cuts two-thirds off their time with DR," said Tim Scalise, McKay-Dee's imaging technology manager.

The radiologic technologists at McKay-Dee can handle both DR and CR, because both technologies "are very simple to use and understand," Scalise noted. "We are in a world now where techs don't grow on trees, and we've been able to keep our staff here. Turnover is much lower since the addition of DR," he said.

What's next?

As prices for DR decline over time and systems become more compact, industry observers see manufacturers targeting both high-volume healthcare institutions and lower-volume imaging centers and physician practices. Future DR market growth also will depend on the adoption of digital imaging systems by new customers, such as community hospitals, private-practice orthopedics/radiology groups, and veterinary practices.

The hook for DR will continue to be that its initial investment -- although greater than conventional x-ray and CR -- can be recouped with enhanced throughput and optimized workflow. But future market growth will depend on pricing. If DR prices continue to fall, the technology will become more affordable for midtier imaging facilities, creating the potential for investment in a low-end DR system, rather than high-end CR unit. As long as DR prices remain at current levels, CR will remain an attractive and viable option.

By Wayne Forrest

AuntMinnie.com staff writer

July 25, 2006

Related Reading

Digital x-ray unreliable for evaluating bone healing, May 31, 2006

Asian digital x-ray market primed for growth, February 17, 2006

PACS drives European CR, DR market, January 10, 2006

Workflow gains drive European PACS market

Copyright © 2006 AuntMinnie.com

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.