Top Story

Latest News

State of the RT profession more palpable than ever

April 24, 2024

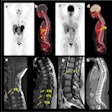

SPECT/CT predicts foot amputations in diabetics

April 24, 2024

Cases of the Week

Check out our Cases of the Week!

More from AuntMinnie

Esaote reports growth in fiscal year 2023

April 25, 2024

Next Generation Radiology Workflow Tools

April 24, 2024

Voiant and Thirona enter commercial partnership

April 24, 2024

Spectral AI names CEO of Spectral IP, plans spin-off

April 24, 2024