Healthcare information technology firm Cerner has signed an agreement to acquire fellow IT firm Dynamic Healthcare Technologies in a stock and cash transaction valued at approximately $20 million.

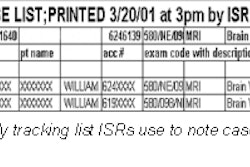

In announcing the deal, Cerner highlighted the benefits of incorporating elements of Dynamic's technology offerings, particularly in pathology, into its HNA Millennium laboratory and anatomical pathology software. Dynamic has also participated in the radiology marketplace via its RadPlus radiology information system and its PACSPlus PACS network.

The outlook for Dynamic’s radiology products would appear to be cloudy, however, as Cerner offers similar products. Cerner has long participated in the RIS sector with its RadNet software, and officially entered the PACS marketplace last month with technology it received through its acquisition of ADAC Health Care Information Systems. Cerner chairman and CEO Neal Patterson expects that many of Dynamic's radiology customers might find Cerner's integrated RIS/PACS technology attractive.

Cerner will continue to provide support to RadPlus users and is not intending to "sunset" the technology, Cerner enterprise vice president of radiology Bill Waters told AuntMinnie.com.

"There will be individual clients with specific needs who we will work with to understand the best manner in which Cerner can help satisfy their IT needs long term," he said. "While we have not decided on any upgrade paths to Cerner's HNA Millennium radiology and PACS solutions for clients who desire it, we will be looking into this in the coming months."

The purchase could top off a turbulent period for Dynamic, which has struggled financially for several years. While the company said its future outlook had improved recently, in June it was forced to perform a reverse stock split to remain in compliance with Nasdaq listing requirements. As larger health systems increasingly demanded integrated, enterprise-wide systems, smaller IT suppliers such as Dynamic faced considerable challenges, said Dynamic CEO Christopher Assif.

Under the terms of the deal, Kansas City-based Cerner will acquire all outstanding shares of Dynamic in exchange for approximately 363,000 shares of Cerner stock, which are currently valued at approximately $17.8 million. In addition, Cerner will redeem all of Lake Mary, FL-based Dynamic's preferred stock for approximately $2.2 million. Cerner expects the deal to have no financial impact this year, and add modestly to earnings beginning in 2002.

The firms expect the transaction to close in the fourth quarter, pending Dynamic shareholder and regulatory approvals. Both companies' shareholders appeared to react positively to the deal. In early trading Thursday, Dynamic shares climbed 9.8% to $2.47 per share, while Cerner gained nearly 2% to $48.92 per share.

By Erik L. RidleyAuntMinnie.com staff writer

September 6, 2001

Related Reading

Cerner gets first PACS sale, August 8, 2001

Dynamic net loss widens in Q2, August 2, 2001

Dynamic adds to radiology client list, July 13, 2001

Dynamic predicts turnaround, June 29, 2001

Dynamic to perform reverse stock split, June 20, 2001

Dynamic Healthcare recompliance gets Nasdaq nod, April 30, 2001

Cerner turns in record Q1, April 19, 2001

Copyright © 2001 AuntMinnie.com