The stock of x-ray developer Nanox has gone on a rollercoaster ride over the past week after a report critical of the company was issued by a short-selling firm. Nanox has charged that the report is full of "errors" and "misleading speculations."

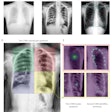

Nanox is developing an x-ray-based system called Nanox.Arc with a futuristic design that the company says will be able to produce 2D and tomography scans of patients. The company plans to install thousands of the systems in rural areas and developing countries, with images analyzed by artificial intelligence (AI) software.

Nanox has successfully raised millions of dollars in funding, and it went public in August in an initial public offering (IPO) that raised $165.2 million. The company's shares closed at $21.70 on the first day of trading on August 21, up 20% from the IPO price. The company has also signed a number of distribution agreements for Nanox.Arc.

But in a critical report published September 15, short-selling firm Citron Research charged the company with perpetrating a "farce" on the market, claiming that since its founding in 2018, the company has only spent $7.5 million on R&D and has not published any papers on its technology. The report notes that GE Healthcare spent $1 billion on R&D in 2019 alone.

The report also claimed that Nanox has never published any data that indicate how the Nanox.Arc compares with a conventional CT scanner. It also criticizes the company for filing a 510(k) application for its product, which implies that the technology is similar to previously cleared devices already on the market.

The Citron report apparently prompted a sharp decline in the company's stock, which closed at a high of $64.18 on September 11, only to tumble to as low as $24.75 on September 22. The decline prompted the filing of a raft of shareholder lawsuits.

In a September 16 press release, Nanox condemned the Citron Research report, which it said "contains factual errors and misleading speculations."

"Nanox believes that the allegations in the report are completely without merit and strongly condemns the publishing of the false and misleading information contained in this report," the company noted.

Shares of Nanox closed at $29.90 on September 22.