An era of constraint that compelled many MRI users to delay replacing their aging equipment may be coming to an end, and a new phase of scanner purchasing could be on the horizon, according to a new report on U.S. market conditions for the modality.

The new report, by IMV Medical Information Division, suggests that the MRI industry may soon see a wave of new installations that would invigorate an aging installed base, and enable MRI providers to capitalize on new clinical applications and productivity features available on new systems.

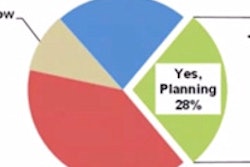

Signs of a break in MRI's long recession were gleaned from 408 responses from MRI or radiology department administrators and MRI lead technologists to an online survey from May to June 2012. Survey results reflect the views of about 5% of the known universe of 7,815 fixed-site and mobile MRI service users in the U.S.

According to the report, the average age of 10,815 fixed MRI scanners in operation increased from 8 years in 2007 to 10.9 years in 2011. The last spike of new installations extended from 2002 to 2004, noted Lorna Young, senior director of market research at IMV.

"Just by doing the math, you can see that the replacement cycle is kicking in," she told AuntMinnie.com.

The increased age of the installed MRI base does not just reflect uncertain times for MRI providers, however; it also indicates that the installed base performed well enough to encourage users to hold on to their equipment longer than was the case 10 years ago, she said.

The top two motivations for replacement were to install MRI scanners with wider patient bores and to replace existing MR systems that have reached the end of their useful lives, according to the survey.

Survey respondents expressed a need for improved breast and MRI angiography applications, and better throughput and productivity with improved coil and multichannel radiofrequency (RF) components available on the current generation of MR systems.

"They can grow their applications to attract referring physicians and improve their department workflow and productivity," Young said. "We expect the market to be strong for the next two or three years."

Demand for 1.5T remains strong

High-field 1.5-tesla MRI remains the modality's mainstay platform. The IMV survey found that 1.5-tesla MRI represents 70% of the installed base and 70% of new installations.

That said, demand for 3-tesla MRI has grown steadily. It comprised 10% of the installed base and 20% of new installations in 2011.

The demand for lower-field-strength systems has all but disappeared, according to the report. Scanners with field strengths of less than 1 tesla accounted for about l0% of the installed base in 2011 and just 1% of planned purchases in 2012.

Potential purchasers have been attracted to 1.5 tesla because lower prices have made it more affordable. Federal policy making site accreditation mandatory for Medicare reimbursement has encouraged providers to retire less powerful MR scanners.

Wide-bore technology also enjoys growing popularity. Approximately 25% of the installed base is equipped with patient bores that are 70 cm or larger in diameter. Survey responses about future purchases revealed that two of every three new installations will be wide-bore systems.

Open MRI is likely to control about 20% of the new installations because of the marketing benefits of systems that are less likely than closed-bore scanners to induce claustrophobic patient reactions, Young said.

The survey found that MRI scans were being performed at 7,375 sites, including more than 3,600 hospitals, 780 hospital-owned outpatient locations, and nearly 3,000 freestanding imaging centers. About 6% of the sites used mobile MRI services in 2011, according to the report.

Mixed utilization findings

Overall MRI use in the U.S. rose an estimated 6% in 2011 to 32 million procedures. The growth rate reflects increasing demand and, to a degree, improvements in identifying active MRI services. Utilization increased 4% per facility, but from 2010 to 2011, the average number of MR procedures per system fell 4%.

Lower and upper extremity imaging grew 15%, from 7.3 million procedures in 2010 to 8.4 million procedures in 2011, making this set of applications the biggest contributor to MRI procedural growth.

Orthopedic and neurological applications also contributed significantly to MRI demand. Spinal MRI comprised 25% of total MR procedures, and lower/upper extremity procedures contributed 26%.

The report supports the theory that general concern about pediatric radiation exposure has not yet translated into more demand for MRI procedures. IMV estimated that pediatric applications were responsible for 10% of total MRI utilization in 2011, a share of total volume that has held steady since 2006. Only 2% of MRI sites -- most likely children's hospitals and clinics -- derive more than 25% of their total MRI volume from pediatric patients.

NSF still a concern

The risk of nephrogenic systemic fibrosis (NSF), a potentially severe reaction to MRI gadolinium contrast in patients with compromised renal function, remains an important clinical management issue. More than 75% of respondents to the IMV survey said NSF prevention is a top patient-management issue for their departments.

Though screening out patients who are potentially susceptible to NSF is a concern, MR department administrators do not believe public concern about the safety of gadolinium-based contrast agents has negatively affected MR procedure volume.

The 120-page report covers MRI utilization, installed base, purchase plans for new and refurbished equipment, upgrades, industry competition, equipment service practices, contrast media and power injector use, and department manager opinions about future trends.

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.