Despite being hampered by the recession, U.S. annual PET and PET/CT procedure volume in the U.S. still increased 7.1% per year from 2008 to 2010, according to a new report issued by market research firm IMV Medical Information Division.

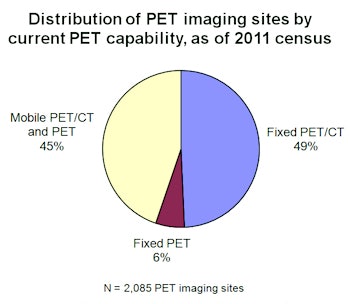

IMV's 2011 study of PET and PET/CT usage estimates that 1.74 million clinical PET patient studies were performed in 2010 on fixed and mobile PET and PET/CT scanners at 2,085 U.S. hospital and nonhospital sites.

"Relative to the procedures that are currently reimbursed and that use currently approved radiopharmaceuticals, the growth is in the single digits but much better than some of the modalities that have been growing at 2% to 3%," said Lorna Young, senior director of market research at IMV.

Growth

Sites performing PET imaging include those with fixed PET/CT scanners or fixed PET-only scanners, as well as those on a mobile route that provides PET scanning services.

IMV's report shows that while the number of fixed and mobile sites performing PET imaging increased a slight 4% -- from 2,000 sites in the 2008 census to 2,085 in 2011 -- the mix of sites using fixed versus mobile PET services has shifted dramatically since 2003. In 2003, one-third of the PET imaging sites used fixed PET or PET/CT units, whereas 55% of the sites now use fixed configurations.

|

| Source: IMV 2011 PET Imaging Market Summary Report |

In addition, the report indicates a sizable shift of sites using fixed PET/CT compared to fixed PET scanners. The number of sites with fixed PET/CT grew 44%, from 715 sites in 2008 to 1,030 in 2011, while fixed PET sites declined 44% from 215 to 120 sites over the same period.

"With the general economic downturn in 2008, PET purchases have been slowed, but steady growth rather than upsurges of pent-up demand is likely," said Young. "Given the procedures that are currently approved, I see the PET market in the U.S. maintaining a relatively steady volume of 140 to 160 units a year."

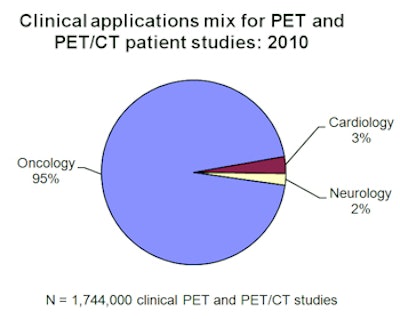

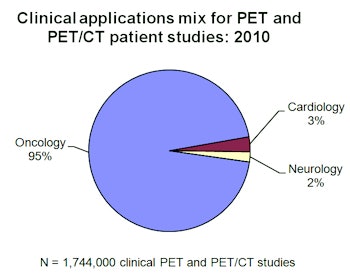

However, as new radiopharmaceuticals come to market, especially agents for diseases such as Alzheimer's, neurological PET applications could see a surge in growth. PET technology is currently used primarily for oncology applications, which comprise 95% of the PET studies. Neurology and cardiology applications make up the remaining 5%, but these areas are likely to become a larger proportion of the studies performed.

|

| Source: IMV 2011 PET Imaging Market Summary Report |

In oncology, lung cancer, breast cancer, lymphoma, and colorectal cancer drive PET oncology utilization. These four cancer types constitute 68% of the PET and PET/CT oncology procedures.

PET imaging is useful for all patient management stages for cancer studies, including diagnosis, staging, treatment planning, and follow-up. Of the estimated 1.65 million PET oncology studies performed in 2010, 19% were for diagnosis, 38% for staging, 10% for treatment planning, and 33% for therapy follow-up.

Over the past decade, the increased availability of fixed PET and PET/CT scanners has reduced wait times. A decade ago, the median waiting period for a nonemergency patient exam (including fixed and mobile scanners) was seven days; it is now four.

The market ahead

Going forward, IMV estimates that approximately half of the market will be first-time buyers, more than one-third will be replacement, and the rest will be additional units.

"We surveyed people who are using fixed or mobile PET, and we're surmising that many if not most of the first buyers are the ones who are building their volume by starting up with mobile PET services, but some nuclear medicine sites may switch over to PET imaging," said Young.

Approximately 45% of the facilities use mobile PET. With nearly half the users still using mobile services, the potential for future conversion exists as sites grow their volume and their referrals.

As new procedures develop and volumes increase, fixed PET imaging sites accustomed to a 40-hour work week will likely have to examine the possibility of extending operation times instead of purchasing additional units.

"The increase in uptake right now is in sites using mobile that are going to purchase fixed, but when it comes to adding PET units, it may still be relatively slow," said Young.

"However, new technology is on the horizon that may stimulate demand. For instance, PET/MR is an emerging technology that the larger PET sites may adopt as additional units going forward."

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.