Concerns about the political outlook in Washington, DC, and its effect on healthcare policy continue to weigh heavily on the minds of radiology administrators, if the most recent update to the Medical Imaging Confidence Index (MICI) is any indication.

The latest MICI survey on the outlook for the second quarter of 2017 found many radiology administrators worried about efforts to repeal the Affordable Care Act (ACA) and replace it with the American Health Care Act (AHCA). The U.S. House of Representatives took the first step by passing the AHCA earlier this month.

Administrators expressed sentiments including "extreme concern" and worries that the changes are "slowing and stopping investment in people and capital" at their hospital. Others reported patient visits declining as individuals were "not wanting to spend deductible requirements at this time."

"The political uncertainty of repeal and replace is also keeping us at a standstill; volumes overall continue to decline as patients face high deductibles," one survey respondent said.

On the other hand, while most comments to the survey reflected an air of uncertainty, the MICI numbers themselves did not demonstrate much change for the second quarter relative to previous periods. And at least one administrator welcomed the change, saying that the Trump administration "fully understands what it takes to run a business."

For the 2017 second-quarter data, MICI surveyed 177 participants from across the U.S., with 13% based in the Mid-Atlantic region, 16% in the South Atlantic region, 8% in the East South Central region, 22% in the East North Central region, 15% in the West North Central region, 11% in the West South Central region, 5% in the Mountain region, and 11% in the Pacific region.

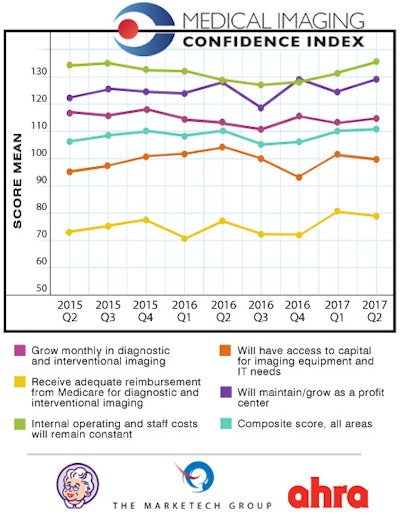

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

MICI scores for the second quarter of 2017 and their relationship to the previous eight quarters are shown in the following chart.

Among the individual components of the index, administrators showed the most optimism that their internal operating and staff costs will remain constant, with a mean score of 136. Next up was confidence that their facility will maintain/grow as a profit center, with a score of 129, followed by confidence in their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 115.

Administrators were neutral on their outlook for accessing capital for imaging equipment and IT needs, with a score of 100. At the low end of the scale was confidence in getting adequate reimbursement from Medicare, with a score of 79.

The MICI composite score across all five topics was 111, edging into the high confidence range.

| MICI Q2 2017 scores by topic | ||

| Topic | Mean score | Interpretation |

| Internal operating and staff costs will remain constant | 136 | Very high confidence |

| Will maintain/grow as a profit center | 129 | High confidence |

| Will grow monthly in diagnostic and interventional imaging | 115 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 100 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 79 | Low confidence |

| Composite score across all areas | 111 | High confidence |

The index is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Members of the MICI panel answer questions about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects. The MICI survey is produced by the AHRA and market research firm the MarkeTech Group.