The election of Donald Trump as U.S. president seems to have prompted many radiology administrators to take a wait-and-see attitude toward their future business operations, if new data from the Medical Imaging Confidence Index (MICI) for the first quarter of 2017 are any indication.

While most indicators for MICI seem to be trending upward, the difference between the first quarter of 2017 and previous surveys for 2016 isn't statistically significant. In comments made to MICI pollsters, many survey respondents expressed the opinion that the Trump administration's stated goal of repealing and replacing the Affordable Care Act (ACA) has them pensive for the future of healthcare.

The Medical Imaging Confidence Index is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Members of the MICI panel answer questions about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects. The MICI survey is produced by the AHRA and market research firm the MarkeTech Group.

For the 2017 first-quarter data, MICI gathered 183 survey participants from across the U.S., with 14% based in the Mid-Atlantic region, 15% in the South Atlantic region, 8% in the East South Central region, 21% in the East North Central region, 16% in the West North Central region, 12% in the West South Central region, 5% in the Mountain region, and 10% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

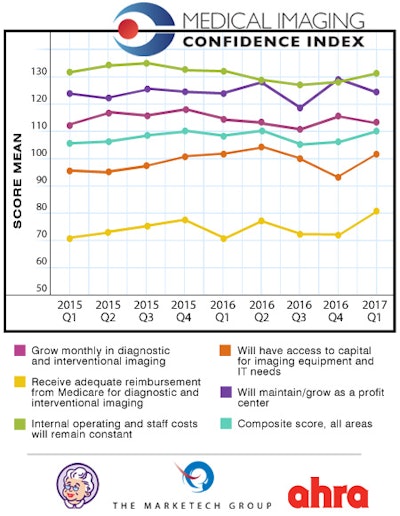

MICI scores for the first quarter of 2017 and their relationship to the previous eight quarters are shown in the following chart.

When it comes to scores for individual components of the index, administrators showed the most optimism that their internal operating and staff costs will remain constant, with a mean score of 131. Next up was confidence that their facility will maintain/grow as a profit center, with a score of 125, followed by confidence in their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 113.

Administrators were neutral on their outlook for accessing capital for imaging equipment and IT needs, with a score of 102. The MICI composite score across all five topics was 110, also representing a neutral outlook. At the low end of the scale was confidence in getting adequate reimbursement from Medicare, with a score of 81.

| MICI Q1 scores by topic | ||

| Topic | Mean score | Interpretation |

| Internal operating and staff costs will remain constant | 131 | Very high confidence |

| Will maintain/grow as a profit center | 125 | High confidence |

| Will grow monthly in diagnostic and interventional imaging | 113 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 102 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 81 | Low confidence |

| Composite score across all areas | 110 | Neutral |

MICI survey respondents were also asked to provide comments that reflect their opinions on the first quarter of 2017. Uncertainty about the fate of the Affordable Care Act was a common theme.

"I believe there is significant uncertainty around healthcare with the new leadership in Washington," one respondent said. "This is causing organizations to sit on cash reserves until we can learn what the future holds."

Several others commented that while they thought the Trump administration would be good for U.S. business in a general sense, they weren't so sure about the healthcare sector.

"With a major change on the political landscape, I am optimistic to a degree for the overall growth of the nation, but am not as optimistic with the state of healthcare," another commenter said. "With the talk of the potential dismantling of Obamacare, there needs to be a solid plan in place which will spell out how the changes to many will be [effected]."

As always, reimbursement remains a concern. One respondent said the reimbursement they receive is typically below their cost of delivering services.

"Currently, administrative costs rise while reimbursement continues to decline," another noted. "There is added uncertainty about national healthcare policy and the fate of the ACA and all associated aspects."