The expansion in the use of teleradiology services has been one of the most controversial issues in the radiology market over the past few years. But if a new report from healthcare technology research and advisory firm CapSite is any indication, the controversy isn't affecting interest in remote radiology.

After surveying more than 700 U.S. healthcare provider organizations, CapSite found that nearly half of those who utilize remote radiology services signed either new contracts or renewals for those services in the past year. In addition, the Williston, VT-based firm found that 21% of survey respondents are planning to evaluate remote radiology over the next 18 months.

CapSite also found significant utilization of remote radiology services for final reads.

Of the sites included in the report, 336 had an annual imaging exam volume of 50,000 or less. There were 145 survey participants with an exam volume of 50,001 to 100,000, 86 with an exam volume of 100,001 to 150,000, 50 with an exam volume of 150,001 to 200,000, and 66 with an exam volume of more than 200,000 exams.

When asked who is responsible for reading radiology images at their facility, 30% of respondents indicated that they had facility-employed radiologists with a supplemental remote radiology group. Nineteen percent utilized a remote radiology group, while an additional 19% had facility-employed radiologists. The remaining 32% indicated another arrangement.

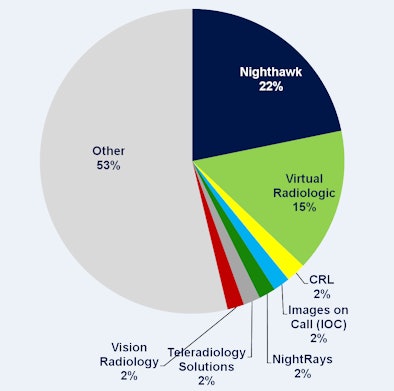

The remote radiology reading market is dominated by two firms: NightHawk Radiology Services of Scottsdale, AZ, and Virtual Radiologic of Eden Prairie, MN; the rest of the market is highly fragmented, according to CapSite.

"Beyond those two, it drops off very quickly," said CapSite vice president Gino Johnson. "That makes it a very unique market in terms of the dynamics and the amount of competition that exists."

|

| Remote radiology market share. All images courtesy of CapSite. |

Variation was also seen in how facilities use remote radiology services:

- Preliminary reads: 35%

- All radiology services: 20%

- Final reads -- night: 13%

- Final reads -- day and night: 13%

- Subspecialty reads: 9%

- Final reads -- day: 7%

- Other: 3%

The number of organizations employing remote radiology services for final reads was a surprising result, said Bryan Fiekers, director of business development. As this is CapSite's first report in this sector, however, it's too early to tell whether this usage represents a growing trend, Johnson said.

In other trends, a number of firms in the remote radiology market are providing smaller community-sized hospitals with a complete radiology department. "This is something that may be an area to watch," Fiekers said.

Of those utilizing remote radiology services, 22% last contracted (either new contracts or renewals) for these services in the past six months, while 24% did so in the past year. Nine percent last contracted over the past 18 months, and 24% had done so over the past two years. The other 21% indicated another time frame.

"If you look at the activity over the last six months to a year ... this highlights that there is a healthy volume of activity happening within this space," Johnson said.

When asked if they have plans to evaluate remote radiology services in the next 18 months, 79% of respondents said no and 21% said yes. Those who do have plans to evaluate these services are doing so for the following reasons:

- To add/change off-hours coverage: 29%

- To improve reading turnaround time: 27%

- To add/change subspecialty coverage: 12%

- For other reasons: 32%

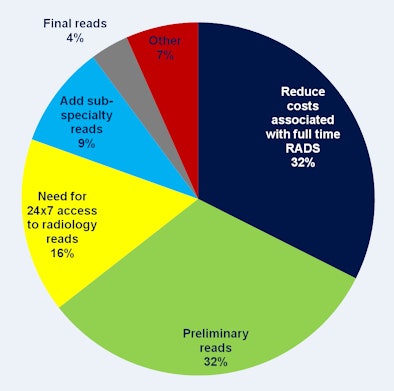

The market is being driven by a number of factors, according to CapSite.

|

| Primary reasons for consideration of remote radiology services. |

Regarding the most important criteria when evaluating remote radiology solution providers, CapSite found that 82% of respondents cited budget, 80% pointed to turnaround time improvement, 47% indicated the ability to provide a fully operational remote radiology department, and 41% were interested in subspecialty expertise. An additional 17% included the provision of a RIS/PACS among their most important criteria.

By Erik L. Ridley

AuntMinnie.com staff writer

September 14, 2010

Related Reading

Radiologist reports problems at Radisphere hospital, August 2, 2010

Are hospitals playing hardball with radiology groups? April 22, 2010

Report: Storage, SR to pace imaging IT, April 22, 2010

Radisphere skirts local groups in bid for hospital contracts, April 15, 2010

Imaging Advantage creates uproar with new business model, July 9, 2009

Copyright © 2010 AuntMinnie.com