Use of radiation therapy in the U.S. is on the rise, with procedure volume growing at an average annual rate of 7%. This growth is occurring even as staffing levels fall within the specialty, according to a new market research report released this week.

Almost 1.1 million cancer patients underwent a course of radiation therapy in 2009, a 15% increase from 2007 statistics, and an average annual rate of 7%, according to the report published by market research firm IMV Medical Information Division of Des Plaines, IL.

The increase in radiation therapy procedure volume may reflect the effects of growth in cancer screening and early detection initiatives, along with aging of the baby boomer generation. More than half (56%) of the radiation therapy procedures performed in the U.S. during the survey period were for just three types of cancer, with breast cancer patients receiving nearly one-fourth of all treatments, followed by prostate and lung cancer patients.

The proportion of types of cancers treated using radiation therapy has remained relatively stable over the past couple of years, with the exception of breast cancer. This increased from 20% to 24% between 2007 and 2009, according to Lorna Young, senior director of market research.

In addition, imaging technology is being increasingly used in the radiation therapy process.

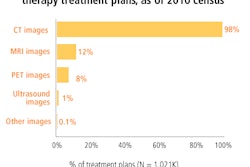

"Digital imaging has become fully integrated into treatment planning, simulation, and to guide tumor treatment real-time," Young said. "Regarding treatment planning, nearly all of the radiation therapy treatment plans use CT images, 12% use MRI, and 8% use PET images. CT images have become a mainstay for treatment planning, but the use of MRI and PET images is growing steadily. Almost two-thirds of the radiation therapy facilities use MRI or PET images for at least some of their treatment plans."

Trends

The IMV report describes trends in the adoption of therapeutic techniques, equipment, and radioactive agents in the U.S. It is based on telephone interviews with 424 hospitals and 147 freestanding cancer treatment centers from December 2009 through June 2010. Responses were then projected to a universe of 2,170 sites, with 64% representing hospital facilities and the remainder representing freestanding radiation oncology or comprehensive cancer treatment centers.

Concurrently, the use of CT for simulation has displaced x-ray simulators, with two-thirds of the current installed base being CT simulators. By comparison, in 2003, IMV reported that x-ray simulators were used by two-thirds of radiation therapy treatment centers. The decline in use of x-ray simulators is continuing, as evidenced by simulator purchase plans: Sites reported that fewer than 10% of planned simulator purchases will be for x-ray simulators.

MRI and PET/CT are beginning to be used for simulation, but the proportion of facilities planning to make purchases of these systems is only in the single digits, Young reported. Most simulator software will include virtual simulation functionality.

In 2009, more than two-thirds of the sites provided treatments using image-guided radiation therapy (IGRT), an increase from 15% in 2004. These facilities used a dedicated IGRT system or electronic portal imaging, ultrasound, x-ray, CT, or conebeam CT as their primary guidance device.

External-beam treatment technology delivered therapeutic radiation for 94% of all patients in the survey period, a number that included treatments from linear accelerators marketed by firms such as Siemens Healthcare of Malvern, PA, and Varian Medical Systems of Palo Alto, CA, as well as systems such as CyberKnife (Accuray, Sunnyvale, CA), GammaKnife (Elekta, Norcross, GA), and TomoTherapy (TomoTherapy, Madison, WI).

The remaining 6% comprised brachytherapy or radionuclide therapy treatments. Stereotactic body radiation therapy was offered by 20% of the facilities in 2009, and 20% also offered cranial stereotactic radiation therapy. Approximately one-third of the sites performed permanent prostate implants and high-dose-rate brachytherapy.

Oncology information systems are now widespread, with only 10% of sites reporting that they do not use any type of record and verify or oncology information system. Almost 70% of the sites that have oncology information systems can access a patient's electronic medical records (EMRs) or have the complete patient record integrated as part of the healthcare IT system. This represents a significant increase since 2007, when only half of these facilities had EMR data accessibility. More than 300 facilities plan to acquire or upgrade oncology information systems from 2010 to 2012, according to IMV.

Effects of U.S. economy

The recession has heavily affected medical centers, and both hospital-based and freestanding radiation oncology treatment centers are budgeting more conservatively. Forty percent of respondents reported that no funds were budgeted for capital equipment in 2011. However, more than 20% of the facilities have budgeted $1 million or more for capital equipment acquisitions in 2011. Young noted that larger hospitals with more than 400 beds have the largest budgets, followed by freestanding cancer treatment centers.

Funds are being predominantly targeted for acquiring external-beam therapy units, with more than one-third of facilities planning to purchase replacement or additional units over the next three years. These purchases will include linear accelerators, CyberKnife, GammaKnife, and TomoTherapy technology. More than half of this new equipment will be used to perform stereotactic treatments, and more than three-quarters plan to have the capability to perform rotational arc therapy.

All told, radiation therapy staff is busier than ever. IMV reported that total full-time equivalent (FTE) staffing has decreased by approximately 6% over the past three years. Radiation therapy treatment centers vary greatly in the type of staff employed, with the larger 400+ bed hospitals having more FTEs on staff for all specified staff categories, including radiation therapists, nurses, medical physicists, dosimetrists, clerical staff, and administrative/supervisory staff. Small hospitals may be more likely to share the services of a medical physicist with another facility.

By Cynthia E. Keen

AuntMinnie.com staff writer

October 28, 2010

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.

Related Reading

Procedure volume falls for radiography/fluoroscopy systems, August 30, 2010

U.S. PACS market rides on replacement sales, June 25, 2010

Procedure volume grows for noncardiac angiography, July 21, 2009

Cardiac cath lab procedures fall 11% over past 2 years, May 26, 2009

Radiation oncology procedure volume edges up, report states, August 28, 2008

Copyright © 2010 AuntMinnie.com