The Deficit Reduction Act (DRA) of 2005 kicked off the U.S. government's effort to reduce what it sees as the overutilization of diagnostic medical imaging, and in its aftermath private payors have followed suit, adopting various modes of cost-cutting with mixed results.

There's no doubt that imaging has been getting the squeeze, and there's no letup in sight, according to Ron Howrigon, president and founder of Fulcrum Strategies in Raleigh, NC, a company that provides physician consulting services. Howrigon spoke at the Radiology Business Management Association's (RBMA) fall conference in San Antonio, cautioning attendees to pay close attention to the imaging market and develop a plan for how to respond to these various cost-management techniques in order to thrive.

Radiology benefits management (RBM) companies argue that the overutilization of diagnostic imaging is a huge problem and costs are growing at rates impossible to match, Howrigon said. The total volume of breast MRI in 2005 was 130,000 procedures, costing about $10.5 million; the predicted volume in 2010 is 1 million procedures, with a price tag of $105 million.

"RBMs describe the so-called 'American Imaging Problem': that outpatient imaging costs have exceeded $100 billion per year and are increasing by 20% annually, that the DRA is driving up volume to commercial payors as providers try to compensate for decreased payment from Medicare, and that up to half of imaging exams ordered don't add any value," he said. "It's negative marketing against medical imaging."

Sinister strategies?

What are the strategies insurers are using to manage imaging costs? They're legion and diverse, Howrigon said, including the hiring of network management companies, requiring accreditation or credentialing in order to offer and perform services, and emphasizing consumer-directed healthcare via tiered networks.

Network management

Network management companies might direct an insurer's members to particular freestanding facilities for advanced outpatient imaging studies rather than using local, hospital-based imaging providers. Often this effort is combined with scan brokering, in which the network management company contracts with its network for a particular amount per scan, and then contracts with the managed care company for a larger amount, keeping not only the difference but also receiving an administrative fee for utilization management service.

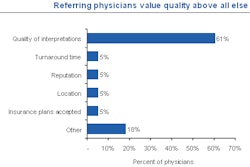

"It becomes more about 'How do I direct patient care to where I want it to go, and therefore lower the cost?'" Howrigon said. "Which wouldn't be bad if all services were of the same quality. But they aren't."

Credentialing and accreditation

Many agree that requiring accreditation can be an effective way of reducing unnecessary imaging use, including the American College of Radiology (ACR), which has developed an accreditation program. With this model, a facility must be credentialed or certified to be considered part of the network; it addresses the practice of self-referral by specialists by requiring them to comply with accreditation requirements they most likely were not complying with before. Use of this strategy may be limited now, but it's growing, Howrigon said.

"UnitedHealthcare instituted this policy this year, and Blue Cross/Blue Shield and Highmark BlueShield have also put it in place," he said. "This is not a bad thing, from my perspective. Advanced imaging should be done on quality equipment that is staffed by trained personnel. This will reduce the number of scans that have to be redone, which reduces costs and in some cases radiation dosage to individual patients."

Tiered networks

Tiered networks are the latest incarnation of pay-for-performance, a concept that gained traction in the 1990s but fizzled when it became clear that implementing it would be too complicated. Like a typical pharmacy co-pay structure, under which patients can choose the amount of their co-pay depending on whether a drug is generic, a preferred brand, or a name brand, tiered networks for imaging would offer patients options for where they receive medical imaging tests. But the structure doesn't translate as well from drugs to imaging, because, unlike the chemical compounds that make up a drug, all imaging isn't equal, according to Howrigon.

"It's like trying to make a Zagat guide for imaging," he said. "Let's say a patient's neurologist is recommending an MRI. She looks up her insurer's list and finds five different facilities with higher or lower co-pays, depending on how much the test costs at each particular site. The patient sees that she can get that MRI for a co-pay of either $50 or $200, and because she doesn't understand the quality difference between the two -- the cheaper one is on a 0.5-tesla magnet and is read by a general radiologist, while the more expensive scan is performed on a 1.5-tesla magnet and read by a neuroradiologist -- she might pick the less expensive co-pay and put her health at risk."

Proaction pays off

What can facilities do as these cost-cutting techniques become more and more ubiquitous? Take proactive action, Howrigon said. Get ahead of the curve on credentialing; do it now rather than after the letter from the insurer comes. Watch for signs of tiered networks and make a plan about how to handle them before they hit your market: If an imaging center is high-priced and dominant in a local market, the strategy might be to emphasize this ("We're expensive, but we're worth it. Do you want a cheap provider when you get an MR for the brain?"); a facility that emphasizes its cost-effective service can focus on that as a marketing strategy.

"In North Carolina, we occasionally have hurricanes," Howrigon said. "The time to put the kit together isn't the day it hits, but during the off-season. Think about how tiered networks will affect your practice and how you'll handle it. The plan will be different depending on where you are in the marketplace, just like a hurricane plan is different for a beach house compared to a place in the mountains."

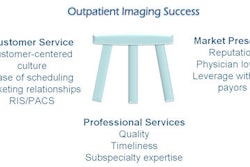

Finally, Howrigon encouraged attendees to foster relationships with referral physicians -- connections that can make or break an imaging facility.

"If the patient's neurologist says he needs an MRI, and he asks if he can go to that center down the street because it's cheaper, he'll probably change his mind no matter what the co-pay ends up being if the neurologist tells him that this other center over here has always done good work," Howrigon said.

By Kate Madden Yee

AuntMinnie.com staff writer

October 13, 2008

Related Reading

GAO: DRA cut 2007 imaging expenses by $1.7 billion, September 26, 2008

AHIP report touts RBMs to control imaging costs, July 29, 2008

GAO report on overutilization draws industry ire, July 15, 2008

Report: Payors putting squeeze on imaging overuse, July 11, 2008

2009 MPFS proposal: If you're not an IDTF, you'll be one soon, July 10, 2008

Copyright © 2008 AuntMinnie.com